الدين العام للولايات المتحدة

اعتباراً من الربع الثاني من عام 2023، بلغت نسبة دين الحكومة الفدرالية إلى الدخل 6.75 إلى 1.

| هذا المقال جزء من سلسلة عن |

| الميزانية والدين في الولايات المتحدة الأمريكية |

|---|

|

الدين العام الأمريكي (United States public debt)، هو ويطلق عليه عادة الدين العام (National debt)، هو إجمالي الأموال التي تدين بها الحكومة الفدرالية للولايات المتحدة إلى حملة صكوك الدين الأمريكي. الدين العام في نقطة زمنية معينة هو القيمة الاسمية لسندات الخزانة القائمة في ذلك الوقت والتي أصدرتها وزارة الخزانة والوكالات الفدرالية الأخرى.

غالباً ما تشير المصطلحات ذات الصلة، مثل "العجز الوطني" و"الفائض الوطني"، إلى رصيد الموازنة الفدرالية الحكومية من سنة لأخرى، وليس إلى إجمالي الدين المتراكم. في سنة العجز، يزداد الدين الوطني كلما احتاجت الحكومة إلى اقتراض أموال لتمويل العجز. أما في سنة الفائض، فينخفض الدين كلما زادت الأموال المستلمة عن الإنفاق، مما يُمكّن الحكومة من خفض الدين عن طريق إعادة شراء سندات الخزانة. بشكل عام، يزداد دين الحكومة الأمريكية نتيجة الإنفاق الحكومي وينخفض نتيجة الضرائب أو تحصيلات التمويل الأخرى، وكلاهما يتقلب خلال السنة المالية.[1][2] إن المبلغ الإجمالي الذي تستطيع وزارة الخزانة اقتراضه يقتصر على سقف الدين الأمريكي.[3]

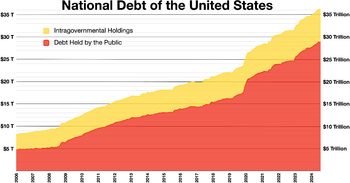

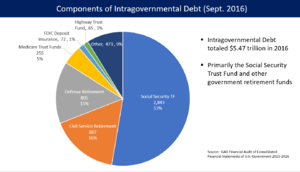

يتضمن الدين القومي الإجمالي على مكونين:[4]

- "الديون لدى العامة" - مثل سندات الخزانة التي يحملها المستثمرون خارج الحكومة الفدرالية، ومن بينهم الأفراد، المؤسسات، نظام الاحتياط الفدرالي، الحكومات الأجنبية، الولائية والمحلية.

- "ديون الحسابات الحكومية" أو "الدين الحكومي" - وهو عبارة عن سندات الخزانة غير القابلة للتسويق ضمن حسابات البرامج التي تديرها الحكومة الفدرالية، مثل صندوق ائتمان الضمان الاجتماعي. تمثل الديون التي تحتفظ بها الحسابات الحكومية الفوائض التراكمية، بما في ذلك أرباح الفوائد، للبرامج الحكومية المختلفة التي تم استثمارها في سندات الخزانة.

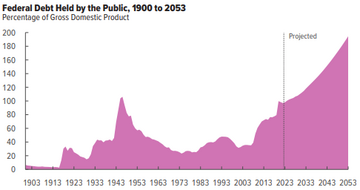

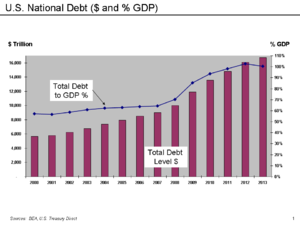

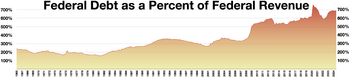

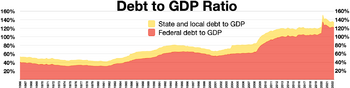

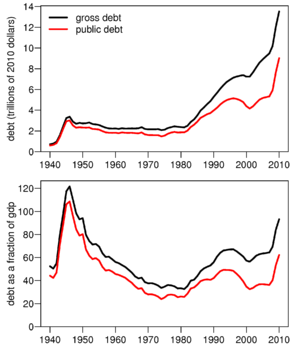

تاريخياً، كان الدين العام للولايات المتحدة يعتبر حصة في الناتج المحلي الإجمالي، تزيد أثناء الحروب والكساد، ثم تنخفض. قد تنخفض نسبة الدين إلى الناتج المحلي الإجمالي نتيجة الفائض الحكومي أو بسبب نمو الناتج المحلي الإجمالي والتضخم. على سبيل المثال، بلغ الدين الذي يملكه العامة كنسبة من الناتج المحلي الإجمالي ذروته بعد الحرب العالمية الثانية (113% من الناتج المحلي الإجمالي في عام 1945)، لكنه انخفض بعد ذلك على مدى السنوات الـ35 التالية. في العقود الأخيرة، أدت التركيبة السكانية (ارتفاع الشيخوخة)وارتفاع تكاليف الرعاية الصحية إلى القلق بشأن الاستدامة طويلة الأجل للسياسات المالية للحكومة الفدرالية.[5] إن المبلغ الإجمالي الذي يمكن للخزينة اقتراضه محدودبسقف الدين الأمريكي.[6]

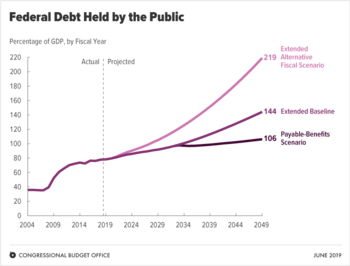

اعتباراً من 13 أبريل 2020، وصل الدين الفدرالي المملوك للعامة إلى 18.2 تريليون دولار وبلغ الدين الحكومي 6.0 تريليون دولار، ليصل إجمالي الدين العام 24.2 تريليون دولار.[7][8] في نهاية 2019، كان الدين المملوك للعامة حوالي 79.2% من ن.م.إ،[9][10] وكان حوالي 37% منه مملوكاً لأجانب.[11] لدى الولايات المتحدة أكبر دين خارجي في العالم. عام 2017، احتلت الولايات المتحدة الترتيب 43 من حيث معدل الدين إلى الناتج المحلي الإجمالي في قائمة تضم 207 بلداً.[12] حسب تنبؤات مكتب الميزانية بالكونگرس في أبريل 2018، سيرتفع الدين المملوك للعامة بما يقارب 100% من ن.م.إ. بحلول عام 2018، وقد يصل لأعلى من ذلك إذا استمرت الحكومة الفدرالية في تطبيق سياساتها المالية الحالية.[13]

بسبب جائحة ڤيروس كورونا، سن الكونگرس بطلب من الرئيس ترمپ قانون المساعدة، الإغاثة والأمن الاقتصادي لڤيروس كورونا (CARES) في 18 مارس 2020. قدرت لجنة الميزانية الفدرالية المسئولة أن عجز الميزانية للسنة المالية 2020 سيصل إلى 3.8 تريليون، أو 18.7% من ن.م.إ، الأعلى في تاريخ الاقتصاد الأمريكي.[14]

لدى الولايات المتحدة أكبر دين خارجي في العالم. بلغ إجمالي سندات الخزانة الأمريكية التي تحتفظ بها جهات أجنبية 7.7 تريليون دولار أمريكي في ديسمبر 2021، بزيادة عن 7.1 تريليون دولار أمريكي في ديسمبر 2020. وتجاوز إجمالي دين الحكومة الفدرالية الأمريكية حاجز 30 تريليون دولار أمريكي لأول مرة في التاريخ في فبراير 2022.[15] اعتباراً من ديسمبر 2023، بلغ إجمالي الدين الفدرالي 33.1 تريليون دولار؛ 26.5 تريليون دولار في حوزة الجمهور و12.1 تريليون دولار في الديون داخل الحكومة.[16] بلغت التكلفة السنوية لخدمة هذا الدين 726 بليون دولار في يوليو 2023، وهو ما يمثل 14% من إجمالي الإنفاق الفدرالي.[17][18] بالإضافة إلى ذلك، في العقود الأخيرة، أدت الشيخوخة الديموغرافية وارتفاع تكاليف الرعاية الصحية إلى إثارة القلق بشأن الاستدامة طويلة الأجل للسياسات المالية للحكومة الفدرالية.[19]

في فبراير 2024، ارتفع إجمالي الدين الحكومي الفدرالي إلى 34.4 تريليون دولار بعد أن نما بنحو تريليون دولار في فترتين منفصلتين مدتهما 100 يوم منذ يونيو السابق.[20] اعتباراً من 6 مارس 2025، بلغ الدين الحكومي الفدرالي 36.56 تريليون دولار.[21]

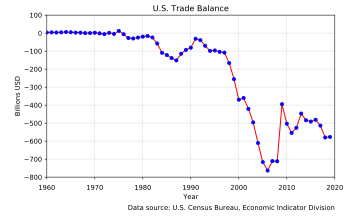

يجب عدم الخلط بين عجز ميزانية الحكومة الفدرالية والعجز التجاري، والذي يشير إلى الفرق بين صافي الصادرات والواردات. كما تقوم الحكومات المحلية وحكومات الولايات بإصدار سلسلة السندات المالية المحلية على مستوى الولايات، وهي ليست جزءا من دين الحكومة الأمريكية.[22] يظهر العجز في الأموال النقدية أكثر منه في المستحقات، بالرغم من أن عجز المستحقات يعطي معلومات أكثر على التنبؤات المدى الطويل للعمليات السنوية الحكومية.[23]

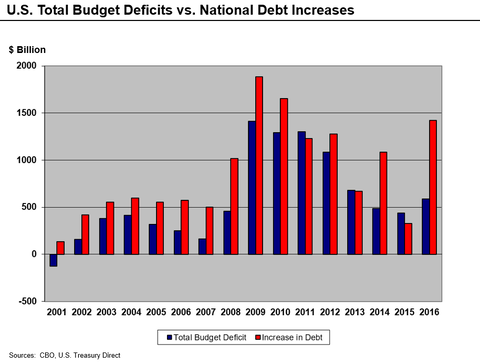

يشير الفائض أو العجز الحكومي السنوي إلى الفرق النقدي بين المبالغ المحصلة والمنفقة من قبل الحكومة مع تجاهل التحويلات الحكومية الداخلية. يزيد أو ينخفض اجمالي الدين العام كنتيجة لفائض أو عجز الميزانية الموحدة. ومع ذلك، فإن هناك بعض الإنفاق (اعتمادات كلية) تضاف إلى إجمالي الدين لكن يتم استبعادها من العجز. زاد إجمالي الديون عن $500 بليون لكل سنة منذ سنة 2003، ثم بزيادة 1 ترليون في سنة 2008، ثم 1.9 تريليون في سنة 2009، و1.7 تريليون دولار في 2010.[24] جنبا إلى جنب مع العجز في الميزانية، فقد كان الدين العام أحد الأسباب التي قدمتها ستاندرد أند پورز لخفض ترتيب الولايات المتحدة في توقعات الإئتمان في 18 أبريل 2011.[25]

التاريخ

وُجد الدين العام للولايات المتحدة منذ تأسيسها. ونشأت الديون أثناء الحرب الثورية الأمريكية وبموجب مواد الاتحاد الكونفدرالي أُعلن عن أول قيمة سنوية معلنة والتي بلغت 75.463.476.52 دولار في 1 يناير 1791. من 1796 إلى 1811 حدث 14 فائض وعجزين. وحدثت أول طفرة في الدين بقيام حرب 1812. في العشرين سنة الأولى عقب حرب 1812، 18 الفائض were experienced وسددت الولايات المتحدة 99.97% من ديونها.

وقعت الطفرة الثانية في النمو الهائل للديون بسبب قيام الحرب الأهلية. ووصلت قيمة الدين العام 65 مليون دولار في عام 1860، ولكنها تجاوزتها إلى 1 بليون في عام 1863 ووصل إلى 2.7 بليون في أعقاب الحرب. في الـ47 عام التالية عادت الحكومة الأمريكية لإدارة الفوائض في وقت السلم لتحقق 36 فائض و11 عجز فقط. أثناء هذه الفترة تم سداد 55% من هذه الديون.

وبمجئ الحرب العالمية الأولى كانت الفترة التالية لطفرات النمو للدين الأمريكي حيث وصل في نهايتها إلى 25.5 بليون دولار. وأعقبها تحقيق فائض وانخفض اجمالي الدين بنسبة 36%.

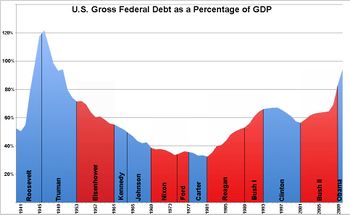

سُنت البرامج الاجتماعية أثناء الكساد الكبير وتراكمت وارتبكت أثناء الحرب العالمية الثانية في فترات رئاسة روزڤلت وترومان في الثلاثينيات والأربعينيات مما أدى لأكبر زيادة - 16 ضعفا - في اجمالي الدين العام من $16 بليون دولار في عام 1930 إلى 260 بليون في عام 1950. عندما تسلم روزڤلت الرئاسة في عام 1933، كان الدين العام 20 بليونا؛ ما يعادل 20% من الناتج المحلي الإجمالي للولايات المتحدة، وفي فترة رئاسته الأولى، حققت إدارة روزڤلت عجوزات سنوية كبيرة ما بين 2 و5% من الناتج المحلي الإجمالي. فبحلول عام 1936، تزايد الدين العام ليصل إلى 33.7 بليون أي ما يعادل 40% من الناتج المحلي الإجمالي.[26]

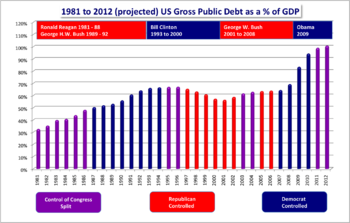

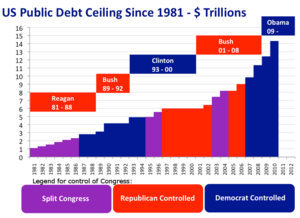

ثم في أعقاب هذه الفترة، تماثل اجمالي الدين العام تقريبا مع معدل التضخم حيث تضاعف ثلاث مرات من 260 بليون دولار في عام 1950 إلى حوالي 909 بليون في عام 1980. وتضاعفت القيمة الاسمية اجمالي الدين بأربع مرات أثناء رئاسة ريگان وبوش من عام 1980 إلى 1992. وتضاعف صافي الدين العام حسب القيمة الاسمية.

ارتفع صافي الدين العام حسب القيمة الاسمية للدولار ثم انخفض بين عامي 1992 و2000 من 3 تريليون في عام 1992 إلى 3.4 تريليون في عام 2000. أثناء ادارة الرئيس جورج دبليو بوش، ازداد اجمالي الدين العام من 5.7 تريليون في عام 2001 إلى 10.7 تريليون في ديسمبر 2008.[27] تحت رئاسة باراك اوباما، ازداد الدين من 10.7 تريليون إلى 14.2 تريليون دولار في فبراير 2011.[28]

منذ أن بدأ الاقتصاد الأمريكي في النمو بعد عامين تقريبا من الحرب العالمية الثانية، ارتبط حجم الدين العام بالاقتصاد (أي كنسبة من الناتج المحلي الاجمالي) كمفتاح قياس آخر. وارتفع الناتج المحلي الاجمالي مرتبطا باجمالي الدين إلى أكثر من 100% نتيجة لنفقات الحرب العالمية الثانية ثم انخفض مرة أخرى، ليرتفع في الثمانينيات كجزء من الحرب الباردة ومرة أخرى بسبب الركود الاقتصادي والقرارات السياسية في أوائل القرن الحادي والعشرين.

أثناء السبعينيات، انخفض الدين العام من 28% إلى 26% من الناتج المحلي الاجمالي. ثم أثناء الثمانينيات ارتفع إلى 41% من الناتج المحلي الاجمالي. وفي التسعينيات، ارتفع ليصل إلى 50% ثم انخفض إلى 39% و40% و62% بنهاية السنة المالية العقد.ثم من 2000-2008، عاد ليرتفع من 35% إلى 40% وإلى 62% بحلول السنة المالية 2010.[29]

التقييم والتقدير

حسابات الحكومة والحسابات العامة

اعتباراً من 6 مارس 2025، بلغ الدين الذي يحمله العامة 29 تريليون دولار، وبلغت الديون الحكومية 7.4 تريليون دولار، بإجمالي 36.4 تريليون دولار.[30] عام 2017 بلغ الدين العام حوالي 77% من الناتج المحلي الإجمالي، وهو ما يجعل الولايات المتحدة في المرتبة 43 من بين 207 بلد.[12] في أبريل 2018 توقع مكتب الميزانية بالكونگرس أن النسبة سترتفع إلى ما يقرب من 100% بحلول عام 2028، وربما أعلى إذا تم تمديد السياسات الحالية بعد تاريخ انتهاء صلاحيتها المقرر.[13]

كما يمكن تصنيف الدين القومي إلى سندات مالية قابلة للتسويق أو غير قابلة للتسويق. معظم السندات المالية القابلة للتسويق هي سندات، فواتير، وصكوك خزانة يحملها مستثمرون وحكومات عالمية. السندات المالية الغير قابلة للتسويق تتألف بصفة رئيسية من "سلسلة حسابات حكومية" مملوكة لصندايق ضمان حكومي معينة مثل الصندوق الائتماني للضمان الاجتماعي، الذي كان يمثل 2.82 تريليون دولار في 2017.[31]

تمثل السندات المالية الغير قابلة للتسويق المبالغ المملوكة للمستفيدين من البرامج. على سبيل المثال، in the casupon receipt, but spent for other purposes. إذا استمرت الحكومة في إدارة العجز في أجزاء أخرى من الميزانية، فسيتعين على الحكومة إصدار الدين الذي يمتلكه العامة لتمويل الصندوق الائتماني للضمان الاجتماعي، مما يؤدي في الواقع إلى استبدال نوع من الدين بالآخر.[32] ومن ضمن أكبر حاملي الديون الحكومية الآخرين إدارة الإسكان الفدرالي، صندوق المؤسسة الفدرالية لضمان المدخرات والقروض والصندوق الفدرالي الإئتماني للمستشفيات (مـِدكير).[بحاجة لمصدر]

المعالجة المحسابية

يتم الإبلاغ فقط عن الديون التي يحتفظ بها العامة كالتزام على البيانات المالية الموحدة لحكومة الولايات المتحدة. إن الدين الذي تحتفظ به الحسابات الحكومية هو أصل لتلك الحسابات ولكنه ملزماً للخزانة؛ يعوضوا بعضهم البعض في البيانات المالية.[33]

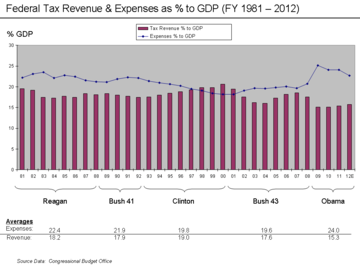

وعادة ما تُعرض الإيرادات والنفقات الحكومية بصيغة نقدية وليس على اساس تراكمي، على الرغم من أن الأساس التراكمي قد يوفر معلومات أكثر حول الآثار طويلة المدى للعمليات السنوية الحكومية.[34] عادة ما يعبر عن الدين العام للولايات المتحدة كمعدل للدين العام مقابل الناتج المحلي الإجمالي. قد ينخفض معدل الدين مقابل الناتج المحلي الإجمالي نتيجة للفائض الحكومي وكذلك بسبب نمو الناتج المحلي الإجمالي والتضخم.[بحاجة لمصدر]

تسيطر الحكومة الفدرالية على مجلس الإشراف على محاسبة الشركات العامة، الذي ينتقد عادةً الممارسات المحاسبية غير المتسقة، لكنها لا تشرف على الممارسات المحاسبية لحكومتها أو المعايير التي وضعها المجلس الاستشاري لمعايير المحاسبة الفدرالية]. بلغت التزامات هذين المجلسين المستقلين، سواءً داخل الميزانية العمومية أو خارجها، ما يزيد قليلاً عن 5 تريليون دولار وقت فرض الوصاية، وتتكون بشكل رئيسي من ضمانات سداد الرهن العقاري وسندات الوكالة.[35] أدى الوضع المربك المستقل لكن خاضع لسيطرة الحكومة للمؤسسات الحكومية إلى قيام المستثمرين في الأسهم العادية والأسهم المفضلة القديمة بإطلاق حملات نشطة مختلفة عام 2014.[36]

استبعاد التزامات فاني ماي وفردي ماك

بموجب قواعد المحاسبة العادية، سيتم دمج الشركات المملوكة بالكامل في دفاتر مالكيها، ولكن الحجم الكبير لفاني وفردي جعل الحكومة الأمريكية مترددة في دمج فردي وفاني في دفاترها الخاصة. عندما طلب فردي ماك وفاني ماي الإنقاذ، أشار جيم نوسل، مدير ميزانية البيت الأبيض جيم نوسل، في 12 سبتمبر 2008، بداية إلى أن خطط ميزانيتهما لن تدمج دين GSE في الميزانية بسبب الطبيعة المؤقتة للتدخل المحافظ.[37] مع استمرار التدخل، بدأت تساؤلات النقاد في التزايد حول هذه المعالجة المحاسبية، مشيرين إلى أن التغييرات التي حدثت في أغسطس 2012 "makes them even more permanent wards of the state وتحول المخزون المفضل للحكومة إلى نوع دائم ومستمر من الأمن".[38]

تسيطر الحكومة الفدرالية على مجلس الرقابة المحاسبية على الشركات العامة، والذي عادة ما ينتقد الممارسات المحاسبية غير المتسقة، لكنه لا يشرف على الممارسات المحاسبية لحكومته أو المعايير التي وضعها المجلس الاستشاري لمعايير المحاسبة الفدرالية. التزامات الميزانية العمومية الداخلية والخارجية لهاتين المؤسستين المستقلتين تحت رعاية الحكومة بلغت أكثر من 5 تريليون دولار عندما conservatorship was put in place، تتألف بصفة رئيسية من ضمانات دفع الرهن العقاري وسندات الوكالة.[35] أدى الوضع المربك "للمؤسسات المستقلة لكنها خاضعة لسيطرة الحكومة" الـGSEs دفع المستثمرين من حاملي الأسهم التقليدية القديمة والأسهم المفضلة إلى إطلاق حملات ناشطية مختلفة في عام 2014.[39]

استبعاد الالتزامات المضمونة

لم يشتمل إجمالي الدين العام ضمانات الحكومة الفدرالية الأمريكية لأنها لم يتم سحبها ضدها. قدمت الحكومة الفدرالية الأمريكية في أواخر 2008 ضمانات لكميات ضخمة من التزامات الصناديق المشتركة والبنوك والشركات في إطار العديد من البرامج المصممة للتعامل مع المشاكل الناشئة عن الأزمة المالية العالمية أواخر عقد 2000. توقف برنامج الضمان في نهاية عام 2012 عندما رفض الكونگرس تمديد الخطة. وأدرج تمويل الاستثمارات المباشرة استجابة للأزمة، مثل تلك التي تمت في إطار برنامج إغاثة الأصول المتعثرة ، في إجمالي الديون.

استبعاد الالتزامات الغير ممولة

الحكومة الفيدرالية الأمريكية ملزمة بموجب القانون الحالي بدفع مبالغ إلزامية لبرامج مثل الرعاية الطبية والعلاج الطبي والضمان الاجتماعي. يتوقع مكتب المحاسبة الحكومي أن تتعدى مدفوعات هذه البرامج بشكل كبير إيرادات الضرائب على مدار الـ75 سنة التالية. تجاوزت مدفوعات الجزء الأول من التأمين الصحي (تأمين المستشفيات) إيرادات ضريبة البرنامج بالفعل، وتجاوزت مدفوعات الضمان الاجتماعي ضرائب الرواتب في السنة المالية 2010. تتطلب هذه العجوزات تمويلاً من مصادر ضريبية أخرى أو الاقتراض.[40] وتقدر القيمة الحالية لهذا العجز أو الالتزامات غير الممولة بـ45.8 تريليون دولار. هذا هو المبلغ الذي كان يجب تخصيصه في عام 2009 لدفع الالتزامات غير الممولة، والتي بموجب القانون الحالي، يتعين على الحكومة جمعه في المستقبل. هناك حوالي 7.7 تريليون دولار متعلقة بالضمان الاجتماعي، بينما 38.2 تريليون دولار متعلقة بالرعاية الصحية والمساعدات الصحية. وبعبارة أخرى، ستحتاج برامج الرعاية الصحية إلى تمويل يزيد بنحو خمسة أضعاف عن الضمان الاجتماعي. إضافة هذا إلى الدين القومي والالتزامات الفدرالية الأخرى سيصل إجمالي الالتزامات إلى ما يقرب من 62 تريليون دولار.[41] ومع ذلك، لا يتم احتساب هذه الالتزامات غير الممولة في الدين القومي، كما هو موضح في تقارير الخزانة الشهرية عن الدين القومي.[42]

قياس نسبة الدين إلى الناتج المحلي الإجمالي

يعتبر الناتج المحلي الإجمالي مقياسا لإجمالي الحجم والإنتاج الاقتصادي. وأحد مقاييس عبء الدين هو حجمه النسبي إلى الناتج المحلي الإجمالي. في السنة المالية 2007، وصل الدين العام الأمريكي إلى. 5 تريليون دولار (36.8% من الناتج المحلي الإجمالي) وكان إجمالي الدين العام $9 تريليون (65.5 % من الناتج المحلي الإجمالي.)[43] ويمثل الدين العام الأموال المستحقة لحملة الأوراق الحكومية مثل أذون الخزانة والسندات. يشمل إجمالي الدين؛ الديون الحكومية الداخلية، والتي تتضمن مبالغ مستحقة لصناديق إئتمان الأمن الضمان الاجتماعي (حوالي 2.2 تريليون دولار في السنة المالية 2007)[44] وصناديق تقاعد الخدمة المدنية. بحلول أغسطس 2008، كان إجمالي الدين 9.6 تريليون دولار.[45]

حسب ميزانية الولايات المتحدة لعام 2010، فقد قارب إجمالي الدين القومي لضعف ما كان عليه في 2008 حسب القيمة الإسمية للدولار، وسوف ينمو لحوالي 100% من الناتج المجلي الإجمالي في 2015، في مقابل ما يقرب من نسبة 80% في أوائل عام 2009.[46] صرحت مصادر حكومية متعددة بما في ذلك الرؤساء الحاليين والسابقين، مكتب محاسبة الحكومة، وزارة الخزانة، ومكتب الميزانية بالكونگرس أن الولايات المتحدة في مسار مالي غير مستدام[47] وإن زيادة نسبة الدين، قد تؤدي لإنهيار قيمة الدولار. وتسديد الديون في حالة إنخفاض سعر العملة يمكن أن يؤدي لالمستثمرون (بما فيهم الحكومات الأخرى) إلى المطالبة برفع سعر الفائدة في حالة توقعها إستمرار إنخفاض سعر الدولار. ودفع معدلات فائدة عالية قد يؤدي إلى بطء النمو في الولايات المتحدة.

إن إرتفاع قيمة الديون يؤدي إلى زيادة الفوائد المدفوعة على الديون، والتي قد تجاوزت بالفعل 430 بليون دولار سنويا كما هو مبين أدناه، أو حوالي 15 سنت لكل دولار ضريبة في عام 2008.[48] حسب كتاب الحقائق الصادر عن وكالة المخابرات المركزية، فإنه يوجد 6 دول فقط تصل نسبة الدين إلى الناتج المحلي الإجمالي لأكثر من 100% في عام 2008، وعلى رأسها اليابان بنسبة 170%.[49]

من ناحية أخرى، فقد تؤدي إرتفاع نسبة الدين إلى الناتج المحلي الإجمالي إلى إبطاء النمو الاقتصادي. ويعتقد الاقتصاديان كارمن رينهارت وكنيث روگوف أن البلدان التي يصل فيها الدين العام إلى 90% من الناتج المجلي الإجمالي بمتوسط 1.3% لكل سنة فإن اقتصادها أبطأ من تلك المثقلة بالديون. وصلت نسبة الدين العام إلى الناتج المحلي الإجمالي في مارس 2010 إلى حوالي 60% من الناتج المجلي الإجمالي؛ وسوف تصل مشروعات مكتب ميزانية الكونگرس إلى 90% في 2020 في ظل السياسات المعمول بها في 2010. وإذا ما حدث بطء في النمو الاقتصادي، فسوف تزداد التحديات الاقتصادية التي تواجهها الولايات المتحدة سوءا.[50]

تكون النسبة أعلى إذا تم استخدام إجمالي الدين القومي، بإضافة "الدين الحكومي" إلى "الدين الذي يملكه العامة". فعلى سبيل المثال، في 29 أبريل 2016، كانت الديون المملوكة للعامة حوالي 13.84 تريليون دولار، أو حوالي 76% من ن.م.إ. بلغت قيمة الاستثمارات الحكومية الداخلية 5.35 تريليون دولار، ليصل إجمالي الدين العام إلى 19.19 تريليون دولار. وبلغ الناتج المحلي الإجمالي للولايات المتحدة خلال الاثني عشر شهراً الماضية حوالي 18.15 تريليون دولار، بنسبة دين إجمالي إلى الناتج المحلي الإجمالي بلغت حوالي 106%.[51]

حساب التغير السنوي في الديون

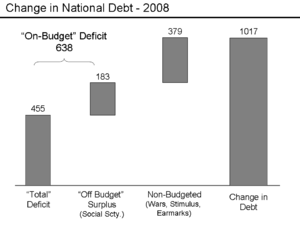

عادة التغيير السنوي في الديون لا يعادل "العجز الكلي" المعلن في وسائل الإعلام. ضرائب رواتب الضمان الاجتماعي ومدفوعات الاستحقاقات، إلى جانب صافي رصيد خدمة البريد الأمريكي، تعتبر "خارج الميدانية"، بينما تعتبر معظم فئات الإنفاق والاستلام الأخرى "ضمن الميزانية". إجمالي العجز الفدرالي هو مجموع العجز في الميزانية (أو الفائض) والعجز خارج الميزانية (أو الفائض). منذ السنة المالية 1960، عانت الحكومة الفدرالية من عجز في الموازنة باستثناء السنة المالية 1999-2000، وإجمالي العجز الفدرالي باستثناء السنة المالية 1969 والسنة المالية 1998- 2001.[52]

إلى حد كبير بسبب فوائض الضمان الاجتماعي، يكون العجز الإجمالي أصغر من العجز في الميزانية. تنفق الحكومة فائض ضرائب الرواتب على الضمان الاجتماعي على مدفوعات الاستحقاقات لأغراض أخرى. ومع ذلك، تقيد الحكومة صندوق الضمان الاجتماعي للمبلغ الفائض، مما يضيف إلى "الديون الحكومية". ينقسم إجمالي الدين الفدرالي إلى "ديون حكومية" و"ديون عامة". وبعبارة أخرى، فإن إنفاق فائض الضمان الاجتماعي "خارج الميزانية" يضيف إلى إجمالي الدين القومي (عن طريق زيادة الدين الحكومي) في حين أن الفائض يقلل من العجز "الإجمالي" المعلن في وسائل الإعلام. بعض الإنفاق المسمى "الاعتمادات التكميلية" هو خارج عملية الموازنة بالكامل ولكنه يزيد من الدين القومي. تم حساب تمويل حربي العراق وأفغانستان بهذه الطريقة قبل إدارة أوباما. بعض الإجراءات التحفيزية والتخصيصات هي أيضاً خارج عملية الموازنة.

على سبيل المثال، في يناير 2009، أفاد مكتب الميزانية بالكونگرس أن "عجز الميزانية" للسنة المالية 2008 بلغ 638 بليون دولار، قابله "فائض خارج الميزانية" (يعود أساساً إلى تجاوز إيرادات الضمان الاجتماعي للمستحقات) بقيمة 183 بليون دولار، ليصل إجمالي العجز إلى 455 بليون دولار. الرقم الأخير هو الأكثر تداولاً في وسائل الإعلام. مع ذلك، تطلبت "إجراءات الخزانة الرامية إلى استقرار الأسواق المالية" مبلغًا إضافيًا قدره 313 بليون دولار، وهو مبلغ مرتفع بشكل غير معتاد بسبب أزمة الرهن العقاري دون الفضلى. هذا يعني أن "الديون العامة" زادت بمقدار 768 بليون دولار (455 بليون دولار + 313 بليون دولار = 768 بليون دولار). تم اقتراض "الفائض خارج الميزانية" وإنفاقه (كما هو الحال عادةً)، مما زاد "الدين الحكومي الداخلي" بمقدار 183 بليون دولار. وبذلك، بلغ إجمالي الزيادة في "الدين الوطني" في السنة المالية 2008 مبلغ 768 بليون دولار + 183 بليون دولار = 951 بليون دولار.[53] أعلنت وزارة الخزانة الأمريكية عن زيادة في الدين العام بقيمة 1.017 بليون دولار للسنة المالية 2008.[54] ومن المرجح أن يكون الفرق البالغ 66 بليون دولار ناتجاً عن "المخصصات الإضافية" المخصصة للحرب على الإرهاب، وبعض هذه المخصصات كانت خارج عملية الميزانية بالكامل حتى بدأ الرئيس أوباما في تضمين معظمها في ميزانيته للسنة المالية 2010.[55]

بمعنى آخر، يُضاف إنفاق فائض الضمان الاجتماعي "خارج الميزانية" إلى إجمالي الدين العام (بزيادة الدين الحكومي)، بينما يُخفّض هذا الفائض "خارج الميزانية" العجز "الإجمالي" الذي تُشير إليه وسائل الإعلام. بعض النفقات، التي تُسمى "الاعتمادات التكميلية"، تقع خارج نطاق عملية الميزانية تماماً، لكنها تُضاف إلى الدين العام. كان تمويل حربي العراق وأفغانستان يُحتسب بهذه الطريقة قبل إدارة أوباما.[55] كانت بعض تدابير التحفيز وتخصيص الأموال أيضاً خارج نطاق عملية الموازنة. تنشر الحكومة الفيدرالية إجمالي الديون المستحقة (الملكيات العامة والداخلية) يومياً.[56]

ملكية الدين

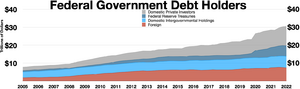

ولأن مجموعة كبيرة ومتنوعة من الأشخاص يمتلكون الأوراق النقدية والأذونات والسندات في الجزء "العام" من الدين، تنشر الخزانة أيضاً معلومات تجمع أنواع أصحاب الفئات حسب الفئات العامة لتوضيح من يملك ديون الولايات المتحدة. في مجموعة البيانات هذه، يتم نقل جزء من الدين العام ودمجه مع إجمالي الدين الحكومة، لأن هذا المبلغ مملوك من قِبل الاحتياطي الفدرالي كجزء من السياسة النقدية للولايات المتحدة. (انظر نظام الاحتياط الفدرالي).

كما هو واضح من الرسم البياني، فإن أقل قليلاً من نصف إجمالي الدين القومي مستحق لـ "الاحتياطي الفيدرالي والأرصدة الحكومية". كما يتم تجميع حاملي الديون الأجانب والدوليين من أقسام الأوراق النقدية والأذونات والسندات. إلى اليمين مخطط للبيانات اعتباراً من يونيو 2008:

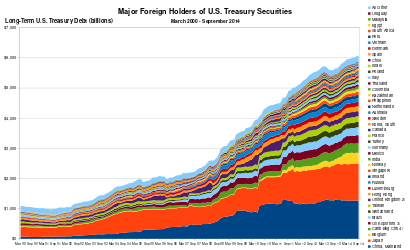

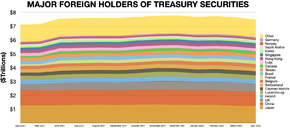

الملكية الأجنبية

اعتباراً من أكتوبر 2018، كان الأجانب يمتلكون 6.2 تريليون دولار من ديون الولايات المتحدة، أو ما يقرب من 39% من الديون التي يحملها الجمهور والتي تبلغ 16.1 تريليون دولار و28% من إجمالي الديون البالغة 21.8 تريليون دولار.[57] في ديسمبر 2020، بلغت حصة الأجانب من الدين العام الأمريكي 33% (7 تريليون دولار من أصل 21.6 تريليون دولار)؛ ومن هذه القيمة البالغة 7 تريليون دولار، كانت حصة الحكومات الأجنبية 4.1 تريليون دولار (59.2%)، بينما كانت حصة المستثمرين الأجانب 2.8 تريليون دولار (40.8%). وبضمّ كلٍّ من حاملي الديون الخاصة والعامة، فإن أكبر ثلاثة دائنين محليين في ديسمبر 2020 هم اليابان (1.2 تريليون دولار أو 17.7%)، والصين (1.1 تريليون دولار أو 15.2%)، والمملكة المتحدة (0.4 تريليون دولار أو 6.2%).[58]

وفي سبتمبر 2014، كان أكبر دائن مفرد للحكومة الأمريكية هو الصين، بنحو 21% من كل سندات الخزانة الأمريكية التي يملكها أجانب (10% من إجمالي الدين العام الأمريكي).[59] ممتلكات الصين من الدين الحكومي، كنسبة من كل الدين الحكومي الذي يحتفظ به أجانب قد ارتفع بشكل ملحوظ منذ عام 2000 (حين كانت الصين تحتفظ بمجرد 6% من كل سندات الخزانة الأمريكية التي يحتفظ بها أجانب).[60]

هذا الانكشاف لمخاطر محتملة مالية أو سياسية لو توقفت البنوك الأجنبية عن شراء سندات الخزانة أو بدأت في بيع ما لديها بكميات كبيرة قد ناقشها في يونيو 2008 تقرير أصدره بنك التسويات الدولية، الذي قال: "المستثمرون الأجانب في أصول بالدولار الأمريكي شهـِدوا خسائر كبيرة مقاسة بالدولار، وكانت تلك الخسائر أكبر إذا ما قيست بعملات أولئك المستثمرين المحلية. وبينما هي غير محتملة، بل تكاد تكون غير واردة للمستثمري القطاع العام، فإن تدافعاً مفاجئاً للخروج لا يمكن وصفه بالمستحيل."[61]

وفي 20 مايو 2007، أوقفت الكويت ربط عملتها بالدولار، مفضلة استخدام الدولار في سلة عملات.[62] سوريا قامت بإعلان مشابه في 4 يونيو 2007.[63] وفي سبتمبر 2009 قالت الصين والهند وروسيا أنهم راغبون في شراء ذهب من صندوق النقد الدولي لتنويع غطائهم المالي الذي يغلب عليه الدولار.[64] إلا أن ادارة سعر الصرف الحكومية الصينية، في يوليو 2010، "استبعدت خيار التخلص من ممتلكاتها الضخمة من سندات الخزانة الأمريكية" وقالت أن الذهب "لا يمكن أن يكون قناة رئيسية لاستثمار احتياطياتنا الضخمة من النقد الأجنبي" لأن سوق الذهب صغير جداً وأسعاره شديدة التقلب.[65]

وحسب پول كروگمان، "حقاً أن الأجانب الآن يمسكون بسندات مطالبة ضخمة على الولايات المتحدة، بما في ذلك قدر معتبر من الدين الحكومي. إلا أن قيمة كل دولار في المستندات الأجنبية على أمريكا يقابلها ما قيمته 89 سنت من مطالبات أمريكية على أجانب. ولأن الأجانب يفضلون إيداع استثماراتهم الأمريكية في أصول آمنة، منخفضة العائد، فإن أمريكا في الواقع تربح المزيد من أصولها في الخارج أكثر مما تدفع للمستثمرين الأجانب. لو الصورة في ذهنك هي لأمة غارقة في الديون للصين، فمعلوماتك خاطئة. كما أننا لا نتجه بسرعة في اتجاه تلك الصورة الخاطئة."[66]

التنبؤ بالدين

تنبؤ مكتب الميزانية بالكونگرس 2018-2028

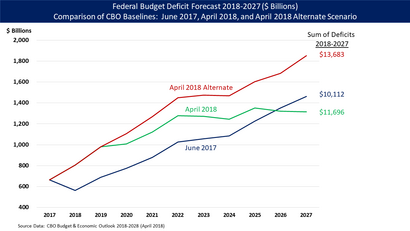

قدر مكتب الميزانية بالكونگرس وقع قانون تخفيض الضرائب والوظائف وتشريع إنفاق منفضل خلال الفترة 2018-2028 في "الميزانية والتوقعات الاقتصادية" السنوية، الصادرة في أبريل 2018:

- من المتوقع أن يبلغ عجز الميزانية في السنة المالية 2018 (والتي تبدأ من 1 أكتوبر 2017 حتى 30 سبتمبر 2018، أول ميزانية وقعها الرئيس ترمپ) 804 بليون دولار، بزيادة 138 بليون دولار (21%) عن ميزانية 2017 والتي بلغت 665 بليون دولار وأكثر بـ242 بليون دولار (39%) عن توقعات خط الأساس السابقة (يونيو 2017) بمبلغ 580 بليون دولار لعام 2018. كانت توقعات يونيو 2017 في الأساس عن مسار الميزانية الموروث من الرئيس أوباما. تم إعداده قبل قانون الضرائب وزيادات الإنفاق في عهد الرئيس ترمپ.

- للفترة 2018-2027، توقع مكتب الميزانية بالكونگرس إجمالي العجز السنوي (أي زيادة الدين) 11.7 تريليون دولار، بزيادة 1.6 تريليون دولار (16%) عن توقعات خط الأساس السابقة (يونيو 2017) الذي يبلغ 10.1 تريليون دولار.

- زيادة الدين بمقدار 1.6 تريليون دولار ويشمل ثلاث عناصر أساسية: 1) انخفاض في العائد 1.7 تريليون دولار بسبب تخفيض الضرائب؛ 2) 1.0 تريليون دولار زيادة في الإنفاق؛ و3) تعويض جزئي من الإيرادات الإضافية بقيمة 1.1 تريليون دولار بسبب النمو الاقتصادي الأعلى مما كان متوقعاً في السابق.

- حسب توقعات مكتب الميزانية بالكونگرس، من المتوقع أن يرتفع الدين المملوك للعامة من 78% من ن.م.إ. (16 تريليون دولار) في نهاية 2018 إلى 96% من ن.م.إ. (29 تريليون دولار) بحلول 2028. سيكون هذا أعلى مستوى منذ نهاية الحرب العالمية الثانية.[بحاجة لمصدر]

- يقدر مكتب الميزانية بالكونگرس حسب سيناريو بديل (حيث يتم الحفاظ على السياسات المعمول بها اعتباراً من أبريل 2018 بعد بدء أو انتهاء الصلاحية المقررة) أن العجز سيكون أعلى بكثير، حيث يرتفع بمقدار 13.7 تريليون دولار خلال الفترة 2018-2027، بزيادة قدرها 3.6 تريليون دولار عن توقعات خط الأساس في يونيو 2017. قد يشمل الحفاظ على السياسات الحالية على سبيل المثال تمديد التخفيضات الضريبية الفردية التي أقرها ترمپ بعد انتهاء مدتها المقررة في عام 2025، من بين تغييرات أخرى.

- زيادة الدين بقيمة 1.6 تريليون دولار تمثل حوالي 12.700 دولار للأسرة (على افتراض أن هناك 126.2 مليون أسرة في 2017)، بينما تمثل 3.6 تريليون دولار، 28.500 دولار لكل أسرة.[13]

توجهات على المدى الطويل

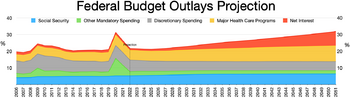

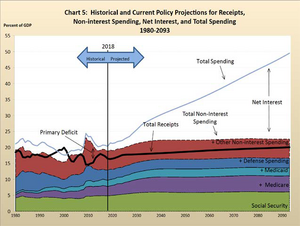

كتب مكتب الميزانية بالكونگرس في 2008: "سيكون النمو المستقبلي في الإنفاق لكل مستفيد من برنامج Medicare وMedicaid - برامج الرعاية الصحية الرئيسية للحكومة الفدرالية - أهم العوامل المحددة للاتجاهات طويلة المدى في الإنفاق الفدرالي. إن تغيير تلك البرامج بطرق تقلل من نمو التكاليف - الأمر الذي سيكون صعباً، ويرجع ذلك جزئياً إلى تعقيد خيارات السياسة الصحية - هو في نهاية المطاف التحدي المركزي طويل الأجل للدولة في وضع السياسة المالية الفدرالية".[67]

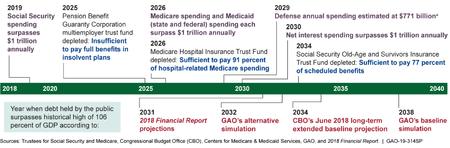

تتسبب التحولات الديموغرافية والإنفاق للفرد في زيادة نفقات الضمان الاجتماعي والرعاية الصحية/الرعاية الطبية بشكل أسرع من الناتج المحلي الإجمالي. إذا استمر هذا الاتجاه، فإن المحاكاة الحكومية في ظل افتراضات مختلفة تتوقع الإنفاق الإلزامي لهذه البرامج ستتجاوز الضرائب المخصصة لهذه البرامج بأكثر من 40 تريليون دولار على مدى السنوات الـ 75 المقبلة على أساس القيمة الحالية.[68]

حسب مكتب الميزانية بالكونگرس، سيؤدي هذا إلى تضاعف معدلات الدين إلى ن.م.إ. بحلول عام 2040 وتضاعفها مرة أخرى بحلول 2060، لتصل إلى 600% بحلول 2080.[69] تشير محاكاة مكتب الميزانية بالكونگرس إلى أن نفقات الضمان الاجتماعي والرعاية الصحية والرعاية الطبية وحدها ستتجاوز 20% من الناتج المحلي الإجمالي بحلول عام 2080، وهي تقريباً النسبة التاريخية للضرائب التي تم جمعها من قبل الحكومة الفدرالية. وبعبارة أخرى، ستستهلك هذه البرامج الإلزامية وحدها جميع الإيرادات الحكومية بموجب هذه المحاكاة.[68]

مقترحات تخفيض الدين

على عكس الاعتقاد الشائع، يتم دائماً تقليل عبء الديون (أي تخفيض نسبة الدين نسبة إلى الناتج المحلي الإجمالي) دون استخدام فوائض الميزانية. لم تسجل الولايات المتحدة فوائض سوى في أربع من السنوات الأربعين الماضية (1998-2001) ولكنها مرت بفترات عديدة تم فيها تخفيض نسبة الدين إلى الناتج المحلي الإجمالي. وقد تحقق ذلك من خلال نمو الناتج المحلي الإجمالي (بالقيمة الحقيقية وعبر التضخم) أسرع نسبياً من الزيادة في الديون.

أسعار الفائدة الحقيقية السلبية

منذ عام 2010، حصلت وزارة الخزانة الأمريكية على أسعار الفائدة الحقيقية السلبية على الدين الحكومي، مما يعني أن معدل التضخم أكبر من سعر الفائدة المدفوعة على الدين.[70] تحدث هذه المعدلات المنخفضة، التي يفوقها معدل التضخم، عندما يعتقد السوق أنه لا توجد بدائل ذات مخاطر منخفضة بما فيه الكفاية، أو عندما تكون الاستثمارات المؤسسية الشعبية مثل شركات التأمين، رواتب التقاعد، أو السندات المالية، الأسواق المالية، و[[صندوق الاستثمار المشترك|صناديق الاستثمار المشترك]، مطلوبة أو تختار استثمار مبالغ كبيرة كافية في سندات الخزانة للتحوط ضد المخاطر.[71][72] أشار اقتصاديون مثل لورنس سمرز ومدونون مثل ماثيو إگلاسياس إلى أنه مع أسعار الفائدة المنخفضة هذه، فإن الاقتراض الحكومي يوفر أموال دافعي الضرائب ويحسن الجدارة الائتمانية.[73][74]

في أواخر الأربعينيات وحتى أوائل السبعينيات، قامت كل من الولايات المتحدة والمملكة المتحدة بتخفيف عبء ديونها بنحو 30% إلى 40% من الناتج المحلي الإجمالي لكل عقد من خلال الاستفادة من أسعار الفائدة الحقيقية السلبية، ولكن ليس هناك ما يضمن استمرار معدلات الدين الحكومية في هذا الوضع المنخفض.[71][75] بين عامي 1946 و1974، انخفضت نسبة الدين إلى الناتج المحلي الإجمالي من 121% إلى 32% على الرغم من وجود فائض في ثماني سنوات فقط من تلك السنوات التي كان فيها أقل بكثير من العجز.[76]

تحويل الاحتياطي الكسري إلى صيرفة احتياط كاملة

نشر صندوق النقد الدولي ورقة عمل بعنوان اعادة النظر في خطة شيكاغو The Chicago Plan Revisited تقترح أن الدين يمكن التخلص منه برفع متطلبات الاحتياط للبنوك، لتتحول من صيرفة احتياط كسري إلى صيرفة احتياط كاملة.[77][78] علق اقتصاديون من كلية پاريس للاقتصاد على الخطة، معلنين أنها بالفعل إبقاء للوضع على ما هو عليه بالنسبة لسك العملة،[79] وقد درس أحد اقتصاديي بنك نورگس المقترح في سياق في سياق اعتبار صناعة التمويل جزءاً من الاقتصاد الحقيقي.[80] تتفق ورقة مركز أبحاث السياسة الاقتصادية مع الاستنتاج القائل بأنه "لا يتم إنشاء أي التزام حقيقي عن طريق إصدار أموال نقدية جديدة، وبالتالي لا يرتفع الدين العام نتيجة لذلك".[81]

المخاطر الاقتصادية والجدل

عوامل الخطر حسب مكتب الميزانية بالكونگرس

أفاد مكتب الميزانية بالكونگرس لعدد من عوامل الخطر المتعلقة بارتفاع مستويات الدين في منشور يوليو 2010:

- سيذهب جزء متزايد من المدخرات نحو شراء الديون الحكومية، بدلاً من الاستثمار في السلع الرأسمالية المنتجة مثل المصانع وأجهزة الحاسوب، مما يؤدي إلى انخفاض الناتج والدخل ما لم يحدث خلاف ذلك؛

- إذا تم استخدام معدلات ضريبة هامشية أعلى لدفع تكاليف الفائدة المتزايدة، سيتم تخفيض المدخرات discouraged العمل؛

- ارتفاع أسعار الفائدة من شأنه أن يفرض تخفيضات في البرامج الحكومية؛

- فرض القيود على قدرة واضعي السياسات على استخدام السياسة المالية للاستجابة للتحديات الاقتصادية؛

- هناك خطر متزايد من أزمة مالية مفاجئة يطالب فيها المستثمرون بأسعار فائدة أعلى.[82]

الاستدامة

يجادل مكتب المحاسبة الحكومية (GAO)، مدقق حسابات الحكومة الفدرالية، بأن الولايات المتحدة تتبع مساراً "غير مستداماً" من الناحية المالية وأن السياسيين والناخبين لا يرغبون في تغيير هذا المسار.[40] علاوة على ذلك، فإن أزمة الرهن العقاري قد زادت بشكل كبير من العبء المالي على الحكومة الأمريكية، بالتزامات أو ضمانات تخطت 10 تريليون دولار و2.6 تريليون دولار في الاستثمارات أو الإنفاقات اعتباراً من مايو 2009، ولم يُدرج سوى جزء منه في حساب الدين العام.[83] ومع ذلك، فإن هذه المخاطر لم يتم تشاركها عالمياً.[84]

المخاطر على النمو الاقتصادي

قد تؤثر مستويات الديون على معدلات النمو الاقتصادي. في عام 2010، أفاد الاقتصاديان كنث روگوف وكارمن رينهارت أنه من بين 20 دولة متقدمة تمت دراستها، كان متوسط نمو الناتج المحلي الإجمالي السنوي 3-4% عندما كان الدين معتدلاً أو منخفضاً نسبياً (أي أقل من 60% من الناتج المحلي الإجمالي) لكنه انخفض إلى 1.6% فقط عندما كان الدين مرتفعاً (أي أعلى من 90% من الناتج المحلي الإجمالي).[85] إلا أن اقتصاديون آخرون، من بينهم پول كروگمان قد زعموا، أن النمو المنخفض يؤدي إلى زيادة الدين القومي، وليس العكس.[86][87][88] في أبريل 2013، أصبحت استنتاجات دراسة روگوف ورينهارت موضع تساؤل عندما تم اكتشاف خطأ ترميز في ورقتهم الأصلية من قبل هيرندون وآش وپولين من جامعة مساتشوستس، أمهرست.[89][90] ووجدوا أنه بعد تصحيح الأخطاء والأساليب غير التقليدية المستخدمة، لم يكن هناك دليل على أن الدين فوق عتبة معينة يقلل من النمو.[91] يؤكد رينهارت وروگوف أنه بعد تصحيح الأخطاء، لا تزال هناك علاقة سلبية بين ارتفاع الدين والنمو.[92]

خلصت ورقة كتبها أربعة خبراء اقتصاديين في فبراير 2013 إلى أن "الدول التي تزيد ديونها عن 80 في المائة من الناتج المحلي الإجمالي والعجز المستمر في الحساب الجاري [التجاري] عرضة للتدهور المالي السريع...".[93][94] كانت العلاقة الإحصائية بين ارتفاع العجز التجاري وارتفاع أسعار الفائدة أقوى بالنسبة للعديد من بلدان منطقة اليورو المضطربة، مما يشير إلى أن الاقتراض الخاص الكبير من الدول الأجنبية (المطلوب لتمويل العجز التجاري) قد يكون عاملاً أكبر من الدين الحكومي في التنبؤ بمعدلات الفائدة.[95]

أعلن بن برنانك، رئيس الاحتياط الفدرالي، في أبريل 2010 أنه لا تشير التجربة ولا النظرية الاقتصادية بوضوح إلى العتبة التي يبدأ عندها الدين الحكومي في تعريض الازدهار والاستقرار الاقتصادي للخطر. ولكن نظراً للتكاليف والمخاطر الكبيرة المرتبطة بالديون الفدرالية التي تتزايد بسرعة، يجب أن تضع أمتنا قريباً خطة ذات مصداقية للحد من العجز، إلى مستويات مستدامة بمرور الوقت".[96]

خطر التضخم

قد يؤدي ارتفاع مستوى الدين إلى التضخم إذا تم النظر إلى تخفيض قيمة العملة كحل لتخفيض الديون. إذا كانت الأجور ترتفع بسبب التضخم، يمكن سداد المبالغ الثابتة من الدين بسهولة أكبر باستخدام الدولار الأرخص سعراً. هذا الأمر يساعد المدين لكنه يضر بالدائن، الذي يحصل على قيمة أقل مقابل قرضه. هناك مجموعة متنوعة من العوامل التي تضع ضغطًا متزايدًا على قيمة الدولار الأمريكي، مما يزيد من خطر انخفاض قيمة العملة أو التضخم ويشجع التحديات التي تواجه دور الدولار بصفته العملة الاحتياطية في العالم.

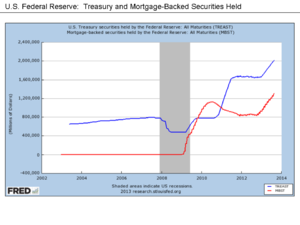

قام مجلس الاحتياطي الفيدرالي الأمريكي بتوسيع العرض النقدي بشكل كبير في أعقاب أزمة الرهن العقاري. وهذا يزيد من خطر التضخم بمجرد استئناف النمو الاقتصادي بمعدلاته التاريخية.[بحاجة لمصدر] صرح بن برنانكي في يناير 2013: "لقد قمنا بزيادة القاعدة النقدية، وهي كمية الاحتياطيات التي تحتفظ بها البنوك مع الاحتياطي الفدرالي. هناك بعض الناس الذين يعتقدون أن ذلك سيكون تضخمياً. أنا شخصياً لا أرى أدلة كثيرة على ذلك. التضخم كما ذكرت كان منخفضاً جداً. توقعات التضخم لا تزال مترسخة ... أعتقد أن لدينا جميع الأدوات التي نحتاجها للتراجع عن حافز سياستنا النقدية وإزالتها قبل أن يصبح التضخم مشكلة".[97]

البرامج الإلزامية

بينما هناك جدل كبير حول الحلول،[98] فإن المخاطر الكبيرة طويلة الأجل التي تفرضها الزيادة في الإنفاق البرنامجي الإلزامي معترف بها على نطاق واسع،[99] مع تكاليف الرعاية الصحية (Medicare و Medicaid) فئة المخاطر الأساسية.[100][101] في مقال رأي نشرته وال ستريت جورنال في يونيو 2010 ، أشار الرئيس السابق للاحتياطي الفدرالي آلان گرينسپان إلى أن "تخفيضات أو تقنين الرعاية الطبية toxic سياسياً فقط، وهي ارتفاع ملحوظ في السن المؤهل الفوائد الصحية والتقاعدية، أو التضخم الكبير، يمكن أن يسد العجز".[102] إذا لم يتم إجراء إصلاحات كبيرة، فإن الفوائد بموجب برامج الاستحقاق ستتجاوز الدخل الحكومي بأكثر من 40 تريليون دولار على مدى السنوات الـ 75 المقبلة.[101]

حساب الفائدة

على الرغم من ارتفاع مستويات الديون، ظلت تكاليف الفائدة عند مستويات عام 2008 تقريباً (بإجمالي 450 مليار دولار تقريباً) بسبب انخفاض أسعار الفائدة المدفوعة لحاملي ديون الخزانة.[103] ومع ذلك، إذا عادت أسعار الفائدة إلى المتوسطات التاريخية، فإن تكلفة الفائدة ستزداد بشكل كبير. وصف المؤرخ نيال فرگسون خطر أن يطلب المستثمرون الأجانب أسعار فائدة أعلى مع ارتفاع مستويات الديون الأمريكية بمرور الوقت في مقابلة نوفمبر 2009.[104]

تعريف الدين العام

يناقش الاقتصاديون أيضاً تعريف الدين العام. جادل كروگمان في مايو 2010 بأن الدين الذي يمتلكه العامة هو المعيار الصحيح الواجب استخدامه، في حين شهد رينهارت أمام اللجنة الرئاسية للإصلاح المالي أن الدين الإجمالي هو المعيار المناسب.[86] استشهد مركز الميزانية والأولويات السياسية ببحث أعده عدد من الاقتصاديين يدعم استخدام الدين المنخفض الذي يمتلكه العامة كمقياس أكثر دقة لعبء الدين، مختلفاً مع أعضاء اللجنة هؤلاء.[105] هناك جدلاً حول الطبيعة الاقتصادية للديون الحكومية، والتي كانت حوالي 4.6 تريليون دولار في فبراير 2011.[106] على سبيل المثال، يزعم مركز الميزانية والأولويات السياسية: أن "الزيادات الكبيرة في [الديون التي يملكها العامة] يمكن أن تؤدي أيضاً إلى رفع أسعار الفائدة وزيادة مبلغ مدفوعات الفوائد المستقبلية التي يجب على الحكومة الفدرالية أن تدفعها للمقرضين خارج الولايات المتحدة، مما يقلل من دخل الأمريكيين. (المكون الآخر من إجمالي الدين) ليس له مثل هذه الآثار لأنه ببساطة أموال تدين بها الحكومة الفدرالية (وتدفع فائدة عليها) لنفسها".[105] ومع ذلك، إذا استمرت حكومة الولايات المتحدة في إدارة عجز "الميزانية" كما هو متوقع من قبل مكتب الميزانية بالكونگرس ومكتب الإدارة والميزانية في المستقبل المنظور، فسيتعين عليها إصدار أذون وسندات الخزانة القابلة للتسويق (أي الديون التي يملكها العامة) لسداد النفقات المتوقعة نقص في برنامج الضمان الاجتماعي. سينتج عن ذلك "الدين المملوك للعامة" بدلاً من "الدين الحكومي".[107][108]

التكافؤ بين الأجيال

هناك جدلٌ حول الدين الوطني حول التكافؤ بين الأجيال. على سبيل المثال، إذا استفاد جيل واحد من برامج حكومية أو حصل على وظائف بفضل الإنفاق الحكومي المتعثر وتراكم الديون، فإلى أي مدى يُشكّل ارتفاع الدين الناتج مخاطر وتكاليف على الأجيال القادمة؟ هناك عدة عوامل يجب مراعاتها:

- مقابل كل دولار من الدين العام، هناك التزام حكومي (عادة ما يكون سندات خزانة قابلة للتداول) يُحسب كأصل من قبل المستثمرين. وتستفيد الأجيال القادمة بقدر انتقال هذه الأصول إليهم.[109]

- اعتباراً من عام 2010، كان حوالي 72% من الأصول المالية مملوكة للـ5% الأكثر ثراءاص من السكان.[110] يطرح هذا تساؤلاً حول توزيع الثروة والدخل، إذ لن يحصل سوى جزء ضئيل من الأجيال القادمة على رأس المال أو الفائدة من الاستثمارات المتعلقة بالديون المتراكمة اليوم.

- بما أن الدين الأمريكي مستحق لمستثمرين أجانب (ما يقارب نصف "الديون التي يحملها الجمهور" خلال عام 2012)، فإن رأس المال والفائدة لا يتلقاها الورثة الأمريكيون مباشرةً.[109]

- إن ارتفاع مستويات الديون يعني ارتفاع مدفوعات الفائدة، وهو ما يخلق تكاليف لدافعي الضرائب في المستقبل (على سبيل المثال، ارتفاع الضرائب، وانخفاض المزايا الحكومية، وارتفاع التضخم، أو زيادة خطر الأزمة المالية).[82]

- إلى الحد الذي يتم به استثمار الأموال المقترضة اليوم لتحسين الإنتاجية طويلة الأجل للاقتصاد وعماله، مثل مشاريع البنية التحتية المفيدة أو التعليم، فإن الأجيال القادمة قد تستفيد.[111]

- مقابل كل دولار من الدين الحكومي الداخلي، هناك التزام تجاه مستفيدين محددين من برامج، وهي عادةً أوراق مالية غير قابلة للتداول، مثل تلك المودعة في صندوق الضمان الاجتماعي. وقد تُحمّل التعديلات التي تُخفّض العجز المستقبلي في هذه البرامج الأجيال القادمة تكاليفها، من خلال زيادة الضرائب أو خفض الإنفاق على البرامج.

كتب الخبير الاقتصادي پول كروگمان في مارس 2013 أنه بإهمالنا للاستثمار العام وعدم خلق فرص عمل، فإننا نلحق ضرراً أكبر بكثير بالأجيال القادمة من مجرد توريث الديون: "السياسة المالية، في الواقع، قضية أخلاقية، وعلينا أن نخجل مما نفعله بالآفاق الاقتصادية للجيل القادم. لكن خطيئتنا تكمن في الاستثمار القليل جدًا، وليس الاقتراض الكثير". يواجه العمال الشباب معدلات بطالة مرتفعة، وقد أظهرت الدراسات أن دخلهم قد يتأخر طوال حياتهم المهنية نتيجة لذلك. تم تخفيض وظائف المعلمين، مما قد يؤثر على جودة التعليم والقدرة التنافسية للأمريكيين الشباب.[112]

سقف الدين

التعريف

بموجب الفقرة 8 من المادة 1 من دستور الولايات المتحدة، الكونگرس وحده هو يمتلك سلطة غقراض الأموال على الائتمان في الولايات المتحدة. منذ تأسيس الولايات المتحدة حتى عام 1917، كان الكونگرس يخول بطريقة مباشرة إصدار كل دين على حدة. من أجل توفير المزيد من المرونة لتمويل مشاركة الولايات المتحدة في الحرب العالمية الأولى، قام الكونگرس بتعديل الطريقة التي يصرح بها بإصدار الدين في قانون سندات الحرية الثاني لعام 1917.[113] بموجب هذا القانون، وضع الكونگرس حداً إجمالياً، أو "سقفاً" للمبلغ الإجمالي للسندات التي يمكن إصدارها. الدنمارك هي الدولة الوحيدة الأخرى التي لديها سقف دين قابل للمقارنة، على الرغم من أن الدنمارك تحدد المستوى مرتفعاً للغاية.[114]

العلاقة مع عملية الاعتماد

تم تحديد سقف الدين الحديث، الذي يتم فيه تطبيق حد إجمالي على جميع الديون الفدرالية تقريباً، بشكل كبير من خلال قوانين الدين العام[115][116] الذي تم تمريره في 1939 و1941.

عملية تحديد سقف الدين منفصلة ومتميزة عن عملية الموازنة الفدرالية، ورفع سقف الدين ليس له أي تأثير مباشر على عجز الموازنة. يقترح الرئيس الأمريكي ميزانية فدرالية كل عام. تعرض هذه الميزانية تفاصيل تحصيلات الضرائب المتوقعة والنفقات، وإذا كان هناك عجز في الميزانية، يقترح الرئيس مبلغ الاقتراض في تلك السنة المالية. يضع الكونگرس فواتير تخصيص محددة تأذن بالإنفاق، والتي يوقعها الرئيس كقانون.

وبالتالي، فإن التصويت لرفع سقف الدين يُعامل عادةً على أنه إجراء شكلي، وهو ضروري لمواصلة الإنفاق الذي سبق أن وافق عليه الكونگرس والرئيس. حسب تفسير مكتب المحاسبة الحكومية (GAO): ""إن سقف الدين لا يتحكم أو يحد من قدرة الحكومة الفدرالية على إدارة العجز أو تحمل الالتزامات. بل هو حد على القدرة على دفع الالتزامات المتكبدة بالفعل".[117] وقد أدت الزيادة الواضحة لسقف الدين إلى اقتراحات بإلغاءه بالكامل.[118][119]

منذ عام 1979، أصدر مجلس النواب قاعدة لرفع سقف الدين تلقائياً عند تمرير الميزانية، دون الحاجة إلى تصويت منفصل على سقف الدين، إلا عندما يصوت مجلس النواب على التنازل عن هذه القاعدة أو إلغائها. تم التذرع بالاستثناء للقاعدة في عام 1995، مما أدى إلى إغلاقين حكوميين.[120]

معايير الخزانة عند الوصول لسقف الدين

الخزانة مفوضة لإصدار الديون اللازمة لتمويل العمليات الحكومية (كما هو مصرح به من قبل كل ميزانية فدرالية) حتى سقف الدين المعلن، مع بعض الاستثناءات الصغيرة. عندما يتم الوصول إلى سقف الدين، يمكن للخزانة أن تعلن عن فترة تعليق لإصدار الديون واستخدام "إجراءات استثنائية" للحصول على أموال للوفاء بالالتزامات الفدرالية ولكنها لا تتطلب إصدار دين جديد. ومن الأمثلة على ذلك تعليق المساهمات في بعض صناديق التقاعد الحكومية. ومع ذلك، فإن هذه المبالغ ليست كافية لتغطية العمليات الحكومية.[121] استخدمت وزارة المالية هذه الإجراءات لأول مرة في 16 ديسمبر 2009، للبقاء تحت سقف الدين، وتجنب إغلاق الحكومة،[122] واستخدمته أيضًا خلال أزمة سقف الدين 2011. ومع ذلك، هناك حدود لمقدار ما يمكن أن ترفعه هذه التدابير.

التاريخ

بين عام 1940 ويناير 2013، تم رفع سقف الديون 54 مرة خلال الإدارات الرئاسية الجمهورية و40 مرة خلال الإدارات الديمقراطية. تم رفع الحد الأقصى 18 مرة خلال إدارة الرئيس ريگان، مع عدم تجاوز أي رئيس آخر 10 مرات. خلال الولاية الأولى للرئيس أوباما، تم رفع الحد الأقصى لسقف الدين ست مرات.[123]

رُفع سقف الدين في 12 فبراير 2010 إلى 14.294 تريليون دولار.[124][125][126] في 15 أبريل 2011، وافق الكونگرس أخيراً على الميزانية الفدرالية الأمريكية 2011، ليخول الحكومة الفدرالية بالإنفاق لبقية السنة المالية 2011، والتي تنتهي في 30 سبتمبر 2011، بعجز 1.48 تريليون دولار،[بحاجة لمصدر] دون التصويت على رفع سقف الدين. لم يتمكن مجلس النواب والشيوخ من الموافقة على تعديل سقف الدين في منتصف عام 2011، مما أدى إلى أزمة سقف الدين الأمريكي. تم حل المأزق بتمرير التعديل في 2 أغسطس 2011، وهو الموعد النهائي لعجز حكومة الولايات المتحدة بشأن ديونها، بموجب قانون ادارة الميزانية 2011، الذي رفع بموجبه سقف الدين إلى 14.694 تريليون دولار، واستلزم تصويت على تعديل موازنة الميزانية، وتأسيس عدة آليات معقدة لرفع سقف الدين وتخفيض الإنفاق الحكومي.

في 8 سبتمبر 2011، تم تطبيق إحدى الآليات المعقدة لزيادة سقف الدين بشكل أكبر بعدما رفض مجلس الشيوخ قراراً لمنع زيادة تلقائية بقيمة 500 مليار دولار. سمح إجراء مجلس الشيوخ بزيادة سقف الدين إلى 15.194 تريليون دولار، على النحو المتفق عليه في قانون مراقبة الميزانية.[127] كانت هذه ثالث زيادة في الدين في غضون 19 شهراً، وخامس زيادة منذ تولي أوباما الرئاسة، والزيادة الثانية عشر في غضون 10 سنوات. كما تأسس بموجب قانون الثاني من أغسطس اللجنة المختارة المشتركة لتخفيض العجز بالكونگرس الأمريكي من أجل تطوير مجموعة من المقترحات بحلول 23 نوفمبر 2011، لتخفيض من الإنفاق الحكومي بمقدار 1.2 تريليون دولار. طالب القانون مجلسي الكونگرس بعقد تصويت "تصاعدي أو تنازلي" على الاقتراحات ككل بحلول 23 ديسمبر 2011. اجتمعت اللجنة المختارة المشتركة لأول مرة في 8 سبتمبر 2011. تم رفع سقف الديون مرة أخرى في 30 يناير 2012، إلى مستوى مرتفع جديد عند 16.394 تريليون دولار.

في منتصف ليل 31 ديسمبر 2012، كان من المقرر أن يدخل حيز التنفيذ أحد البنود الرئيسية لقانون مراقبة الميزانية لعام 2011 (BCA). نص الجزء الحاسم من القانون عل تأسيس لجنة مختارة مشتركة مختارةمن الديمقراطيين والجمهوريين في الكونگرس - المسماة "اللجنة الفائقة" - لإصدار تشريع من الحزبين بحلول أواخر نوفمبر 2012 من شأنه أن يخفض عجز موازنة الولايات المتحدة بمقدار 1.2 تريليون دولار على مدى السنوات العشر القادمة. للقيام بذلك، وافقت اللجنة على التنفيذ بموجب القانون - إذا لم يتم التوصل إلى اتفاق آخر قبل 31 ديسمبر - تخفيضات الإنفاق الحكومية الضخمة وكذلك زيادة الضرائب أو العودة إلى مستويات الضرائب من السنوات السابقة. هذه هي العناصر التي تشكل 'United States fiscal cliff'.[128]

الملحق

الدين القومي لسنوات مختارة

| السنة المالية | إجمالي الدين، $Bln[129][130][131] |

إجمالي الدين، % من ن.م.إ. |

الدين العام، $Bln، 1996– |

الدين العام % من ن.م.إ. |

ن.م.إ.، $Bln، BEA/OMB[132] |

|---|---|---|---|---|---|

| 1910 | 2.65/- | 8.1% | 2.65 | 8.1% | تقديرات 32.8 |

| 1920 | 25.95/- | 29.2% | 25.95 | 29.2% | تقديرات 88.6 |

| 1927 | [133] 18.51/- | 19.2% | 18.51 | 19.2% | تقديرات 96.5 |

| 1930 | 16.19/- | 16.6% | 16.19 | 16.6% | تقديرات 97.4 |

| 1940 | 42.97/50.70 | 43.8–51.6% | 42.77 | 43.6% | -/98.2 |

| 1950 | 257.3/256.9 | 92.0% | 219.00 | 78.4% | 279.0 |

| 1960 | 286.3/290.5 | 53.6–54.2% | 236.80 | 44.3% | 535.1 |

| 1970 | 370.9/380.9 | 35.0–36.0% | 283.20 | 27.0% | 1.061 |

| 1980 | 907.7/909.0 | 32.4–32.6% | 711.90 | 25.5% | 2.792 |

| 1990 | 3.233/3.206 | 54.4–54.8% | 2,400 | 40.8% | 5.899 |

| 2000 | a15.659 | a 55.9% | a 3.450 | 33.9% | 10.150 |

| 2001 | a2 5.792 | a 55.0% | a 3.350 | 31.6% | 10.550 |

| 2002 | a3 6.213 | a 57.4% | a 3.550 | 32.7% | 10.800 |

| 2003 | a 6.783 | a 60.1% | a 3.900 | 34.6% | 11.300 |

| 2004 | a 7.379 | a 61.3% | a 4.300 | 35.6% | 12.050 |

| 2005 | a4 7.918 | a 61.7% | a 4.600 | 35.7% | 12.850 |

| 2006 | a5 8.493 | a 62.3% | a 4.850 | 35.4% | 13.650 |

| 2007 | a6 8.993 | a 62.9% | a 5.050 | 35.3% | 14.300 |

| 2008 | a7 10.011 | a 67.7% | a 5.800 | 39.4% | 14.800 |

| 2009 | a8 11.898 | a 82.2% | a 7.550 | 52.4% | 14.450 |

| 2010 | a9 13.551 | a 91.0% | a 9.000 | 61.0% | 14.900 |

| 2011 | a10 14.781 | a 95.6% | a 10.150 | 65.8% | 15.450 |

| 2012 | a11 16.059 | a 99.7% | a 11.250 | 70.3% | 16.100 |

| 2013 | a12 16.732 | a 100.4% | a 12.000 | 16.650 | |

| 2014 | a13 17.810 | a 102.5% | a 12.800 | 17.350 | |

| 2015 | a14 18.138 | a 100.3% | [134] 13.124 | 18.100 | |

| 2016 | a15 19.560 | a105.5% | [134] 14.173 | 18.550 | |

| 2017 | a16 20.233 | a105.1% | [134] 14.673 | 19.250 | |

| 2018 | a17 21.506 | a106.0% | [134] 15.761 | 20.300 | |

| 2019 | a18 22.711 | a107.4% | [134] 16.809 | 21.150 | |

| 2020 | 26.938 | 128.0% | 21.050 | ||

| 2021 20 أكتوبر – 21 يونيو فقط |

28.529 | 130.6% | 21.850 |

في 27 يوليو 2018، قام مكتب التحليل الاقتصادي بمراجعة أرقام الناتج المحلي الإجمالي في تحديث شامل وتمت مراجعة الأرقام حتى السنة المالية 2013 وفقاً لذلك.[135]

في 25 يونيو 2014، أعلن مكتب التحليل الاقتصادي: "[في 30 يوليو 2014، بالإضافة إلى المراجعة المنتظمة للتقديرات للأعوام الثلاثة الأخيرة وللربع الأول من عام 2014، سيتم مراجعة الناتج المحلي الإجمالي ومكونات مختارة إلى الربع الأول من عام 1999.

استُمدت أرقام الناتج المحلي الإجمالي للسنوات المالية 1940-2009 من أرقام مكتب الإدارة والميزانية الصادرة في فبراير 2011، والتي تضمنت تعديلات على أرقام السنوات السابقة نظرًا لتغييرات جوهرية في قياسات الناتج المحلي الإجمالي السابقة. واستُمدت قياسات الناتج المحلي الإجمالي للسنوات المالية 1950-2010 من أرقام مكتب التحليل الاقتصادي الصادرة في ديسمبر 2010، والتي عادةً ما تخضع للمراجعة، لا سيما في السنوات الأخيرة. بعد ذلك، عُدّلت أرقام مكتب الإدارة والميزانية إلى عام 2004، وأرقام مكتب التحليل الاقتصادي (في مراجعة بتاريخ 31 يوليو 2013) إلى عام 1947.

فيما يتعلق بالتقديرات المسجلة في عمود الناتج المحلي الإجمالي (العمود الأخير) والمُشار إليه برمز "~"، فإن الفروق المطلقة بين تقارير مكتب التحليل الاقتصادي (بعد شهر واحد) السابقة لنسبة تغير الناتج المحلي الإجمالي والنتائج الحالية (حتى نوفمبر 2013) التي وُجدت في المراجعات، تُقدر بـ 1.3% ± 2.0%، أو باحتمال 95% أن تكون ضمن نطاق 0.0-3.3%، بافتراض حدوث الفروق وفقاً للانحرافات المعيارية عن متوسط الفرق المطلق البالغ 1.3%. على سبيل المثال، على سبيل المثال، مع تقرير مسبق بزيادة قدرها 400 بليون دولار في الناتج المحلي الإجمالي البالغ 10 تريليون دولار، يمكن للمرء أن يكون واثقاً بنسبة 95% من أن النطاق الذي يقع فيه المبلغ الدقيق للناتج المحلي الإجمالي بالدولار سيختلف بنسبة تتراوح بين 0.0 و3.3% عن 4.0% (400 ÷ 10,000)، أو ضمن نطاق يتراوح بين 0 و330 بليون دولار عن المبلغ الافتراضي البالغ 400 بليون دولار (أي ما بين 70 و730 بليون دولار). بعد شهرين، ومع تعديل القيمة، يتقلص نطاق فرق الجهد عن التقدير المذكور، وبعد ثلاثة أشهر مع تعديل قيمة أخرى، يتقلص النطاق مجدداً.

تبدأ السنوات المالية 1940-1970 في 1 يوليو من العام السابق (على سبيل المثال، تبدأ السنة المالية 1940 في 1 يوليو 1939 وتنتهي في 30 يونيو 1940)؛ وتبدأ السنوات المالية 1980-2010 في 1 أكتوبر من العام السابق. يُفترض أن تكون الديون الداخلية قبل قانون الضمان الاجتماعي مساوية للصفر.

تقديرات الناتج المحلي الإجمالي للسنة التقويمية 1909-1930 مأخوذة منMeasuringWorth.com[136] تقديرات السنة المالية مستخلصة من الاستيفاء الخطي البسيط.

(a1) كان الرقم المدقق "حوالي 5.659 بليون دولار".[137]

(a2) كان الرقم المدقق حوالي "5.792 بليون دولار".[138]

(a3) كان الرقم المدقق حوالي "6.213 بليون دولار".[138]

(a) قيل أن الرقم المدقق كان "مقارب" للرقم المذكور.[22]

(a4) كان الرقم المدقق حوالي "7.918 بليون دولار".[139]

(a5) كان الرقم المدقق حوالي "8.493 بليون دولار".[139]

(a6) كان الرقم المدقق حوالي "8.993 بليون دولار".[140]

(a7) كان الرقم المدقق حوالي "10.011" بليون دولار".[140]

(a8) كان الرقم المدقق حوالي "11.898 بليون دولار".[141]

(a9) كان الرقم المدقق حوالي "13.551 بليون دولار".[142]

(a10) أكد مكتب محاسبة الحكومة أن قيمة الدين العام بلغت 14.781 بليون دولار.[143]

(a11) أكد مكتب محاسبة الحكومة أن قيمة الدين العام بلغت 16.059 بليون دولار.[143]

(a12) أكد مكتب محاسبة الحكومة أن رقم مكتب الهيئة المالية بلغ 16.732 بليون دولار.[144]

(a13) أكد مكتب محاسبة الحكومة أن رقم مكتب الهيئة المالية بلغ 17.810 بليون دولار.[145]

(a14) أكد مكتب محاسبة الحكومة أن رقم مكتب الهيئة المالية بلغ 18.138 بليون دولار.[146]

(a15) أكد مكتب محاسبة الحكومة أن رقم مكتب الهيئة المالية بلغ 19.560 بليون دولار.[147]

(a16) أكد مكتب محاسبة الحكومة أن رقم مكتب الهيئة المالية بلغ 20.233 بليون دولار.[148]

(a17) أكد مكتب محاسبة الحكومة أن رقم مكتب الهيئة المالية بلغ 21.506 بليون دولار.[149]

(a18) أكد مكتب محاسبة الحكومة أن رقم مكتب الهيئة المالية بلغ 22.711 بليون دولار.[134]الفوائد المدفوعة

بحسب بيانات الحكومة الفدرالية، فإن مدفوعات الفائدة على الديون تجاوزت تريليون دولار في 1 أكتوبر 2023.[150]

تجدر الإشارة إلى أن هذا يشمل كل الفوائد التي دفعتها الولايات المتحدة، بما في ذلك الفوائد المودعة في صناديق الضمان الاجتماعي وغيرها من صناديق الائتمان الحكومية، وليس فقط "الفائدة على الديون" التي يتم الاستشهاد بها بشكل متكرر في أماكن أخرى.

| السنة المالية |

الديون التاريخية المستحقة، بليونUS$،[151] |

الفائدة المدفوعة بليون US$،[152] |

سعر الفائدة |

| 2019 | 22.719 | 574.6 | 2.53% |

| 2018 | 21.516 | 523.0 | 2.43% |

| 2017 | 20.244 | 458.5 | 2.26% |

| 2016 | 19.573 | 432.6 | 2.21% |

| 2015 | 18.150 | 402.4 | 2.22% |

| 2014 | 17.824 | 430.8 | 2.42% |

| 2013 | 16.738 | 415.7 | 2.48% |

| 2012 | 16.066 | 359.8 | 2.24% |

| 2011 | 14.790 | 454.4 | 3.07% |

| 2010 | 13.562 | 414.0 | 3.05% |

| 2009 | 11.910 | 383.1 | 3.22% |

| 2008 | 10.025 | 451.2 | 4.50% |

| 2007 | 9.008 | 430.0 | 4.77% |

| 2006 | 8.507 | 405.9 | 4.77% |

| 2005 | 7.933 | 352.4 | 4.44% |

| 2004 | 7.379 | 321.6 | 4.36% |

| 2003 | 6.783 | 318.1 | 4.69% |

| 2002 | 6.228 | 332.5 | 5.34% |

| 2001 | 5.807 | 359.5 | 6.19% |

| 2000 | 5.674 | 362.0 | 6.38% |

| 1999 | 5.656 | 353.5 | 6.25% |

| 1998 | 5.526 | 363.8 | 6.58% |

| 1997 | 5.413 | 355.8 | 6.57% |

| 1996 | 5.225 | 344.0 | 6.58% |

| 1995 | 4.974 | 332.4 | 6.68% |

| 1994 | 4.693 | 296.3 | 6.31% |

| 1993 | 4.411 | 292.5 | 6.63% |

| 1992 | 4.065 | 292.4 | 7.19% |

| 1991 | 3.665 | 286.0 | 7.80% |

المالكون الأجانب لسندات الخزانة الأمريكية

قائمة كبار المالكين الأجانب لسندات الخزانة الأمريكية، كما تسردهم وزارة الخزانة الأمريكية (تحديث مسح يونيو 2021):[153]

| كبار حاملي سندات الخزانة الأمريكية الأجانب اعتباراً من يناير 2025 | ||

|---|---|---|

| البلد أو المنطقة | بليون دولار (تقديرات) |

% التغير منذ

يناير 2024 |

| 1,079.3 | − 5% | |

| 760.8 | − 5% | |

| 740.2 | + 5% | |

| 409.9 | +18% | |

| 404.5 | +23% | |

| 377.7 | +29% | |

| 350.8 | −0.1% | |

| 335.4 | +31% | |

| 329.7 | − 1% | |

| 301.1 | + 6% | |

| 290.4 | +13% | |

| 255.9 | +10% | |

| 247.6 | +24% | |

| 225.7 | − 4% | |

| 199.1 | −12% | |

| 173.1 | +15% | |

| آخرون | 2.045.3 | +13% |

| الإجمالي | 8.526.5 | + 7% |

احصائيات

- اعتباراً من 31 يوليو 2014، كانت احتياطيات الذهب الرسمية للولايات المتحدة 261.5 مليون أونصة بقيمة دفترية تبلغ حوالي 11.04 بليون دولار

- اعتباراً من سبتمبر 2014، كانت احتياطيات النقد الأجنبي 140 بليون دولار.[155]

- اعتباراً من عام 2020، بلغ الدين الوطني 80.885 دولار للشخص.[156]

- في مارس 2016، بلغ الدين العام 59.143 دولار للفرد من سكان الولايات المتحدة، أو 159.759 دولار لكل عضو من دافعي الضرائب العاملين في الولايات المتحدة.[157]

- عام 2008، أُنفق 242 بليون دولار على مدفوعات الفوائد لخدمة الدين، من إجمالي إيرادات ضريبية بلغت 2.5 تريليون دولار، أي ما يعادل 9.6%. وبإضافة الفوائد غير النقدية المستحقة بشكل رئيسي للضمان الاجتماعي، بلغت الفائدة 454 بليون دولار، أي ما يعادل 18% من الإيرادات الضريبية.[140]

- بلغ إجمالي ديون الأسر الأمريكية، بما في ذلك قروض الرهن العقاري والديون الاستهلاكية، 11.4 تريليون دولار عام 2005. وبالمقارنة، بلغ إجمالي ديون الأسر الأمريكية 11.4 تريليون دولار في 2005.[158]

- في أبريل 2009، بلغ إجمالي بطاقات الائتمان الاستهلاكية الأمريكية المتجددة 931.0 بليون دولار.[159]

- عام 2005، بلغ عجز الميزان التجاري للولايات المتحدة في السلع والخدمات 725.8 بليون دولار.[160]

- وفقاً للتقرير السنوي الأولي لوزارة الخزانة الأمريكية لعام 2014 حول حيازات الولايات المتحدة من الأوراق المالية الأجنبية، قيّمت الولايات المتحدة محفظة سندات الخزانة الأجنبية لديها بنحو 2.7 تريليون دولار أمريكي. أكبر المدينين هم كندا والمملكة المتحدة وجزر كايمان وأستراليا، حيث تبلغ ديونها السيادية المستحقة لسكان الولايات المتحدة 1.2 تريليون دولار أمريكي.[161]

- كان إجمالي الدين العام في عام 1998 مساوياً لتكلفة البحث والتطوير ونشر الأسلحة النووية الأمريكية والبرامج المتعلقة بالأسلحة النووية أثناء الحرب الباردة.[162][163][164]

في دراسة أجرتها مؤسسة بروكنگز عام 1998 ونشرتها لجنة دراسة تكاليف الأسلحة النووية (التي شكلتها مؤسسة و. ألتون جونز عام 1993)، حُسبت إجمالي الإنفاق على الأسلحة النووية الأمريكية في الفترة 1940-1998 بقيمة 5.5 تريليون دولار أمريكي عام 1996.[162] عام 1998 بلغ إجمالي الدين العام في نهاية السنة المالية 1998 مبلغ 5.478.189.000.000 دولار[165] أو 5.3 تريليون دولار عام 1996.

مقارنات ديون دولية

| البلد/المنظمة | 2007 | 2010 | 2011 | 2017/2018 |

|---|---|---|---|---|

| الولايات المتحدة | 62% | 92% | 102% | 108% |

| الاتحاد الأوروپي | 59% | 80% | 83% | 82% |

| النمسا | 62% | 78% | 72% | 78% |

| فرنسا | 64% | 82% | 86% | 97% |

| ألمانيا | 65% | 82% | 81% | 64% |

| السويد | 40% | 39% | 38% | 41% |

| فنلندا | 35% | 48% | 49% | 61% |

| اليونان | 104% | 123% | 165% | 179% |

| رومانيا | 13% | 31% | 33% | 35% |

| بلغاريا | 17% | 16% | 16% | 25% |

| التشيك | 28% | 38% | 41% | 35% |

| إيطاليا | 112% | 119% | 120% | 132% |

| هولندا | 52% | 77% | 65% | 57% |

| پولندا | 51% | 55% | 56% | 51% |

| إسپانيا | 42% | 68% | 68% | 98% |

| المملكة المتحدة | 47% | 80% | 86% | 88% |

| اليابان | 167% | 197% | 204% | 236% |

| روسيا | 9% | 12% | 10% | 19% |

| آسيا 1 (2017+)2 | 37% | 40% | 41% | 80% |

المصادر: يوروستات،[166] صندوق النقد الدولي، النظرة المستقبلية الاقتصادية العالمية (اقتصادات الأسواق الناشئة)؛ منظمة التعاون والتنمية الاقتصادية، النظرة المستقبلية الاقتصادية (الاقتصادات المتقدمة)[167]IMF,[168]

1الصين، هونگ كونگ، الهند، إندونيسيا، كوريا، ماليزيا، الفلپين، سنغافورة وتايلند 2أفغانستان، أرمينيا، أستراليا، أذربيجان، بنگلادش، بوتان، بروناي دار السلام، كمبوديا، الصين، جمهورية الصين الشعبية، فيجي، جورجيا، منطقة هونگ كونگ الإدارية الخاصة، الهند، إندونيسيا، اليابان، قزخستان، كيريباتي، كوريا الجنوبية، قيرغيزستان، لاوس، منطقة ماكاو الإدارية الخاصة، ماليزيا، المالديڤ، جزر مارشال، ولايات ميكرونيزيا الاتحادية، منغوليا، ميانمار، ناورو، نيپال، نيوزيلندا، پاكستان، بالاو، پاپوا غينيا الجديدة، الفلپين، ساموا، سنغافورة، جزر سليمان، سريلانكا، تايوان، طاجيكستان، تايلاند، تيمور الشرقية، تونگا، تركيا، تركمانستان، توڤالو، أوزبكستان، ڤانواتو، ڤيتنام

أحدث الإضافات إلى الدين العام للولايات المتحدة

| السنة المالية (تبدأ 1 أكتوبر من العام السابق إلى العام المذكور) |

ن.م.ا. بليون $ |

الدين الجديد للسنة المالية بليون $ |

الدين الجديد كـ% من ن.م.ا. |

إجمالي الدين بليون $ |

إجمالي الدين كـ % من ن.م.ا. (نسبة الدين:ن.م.ا.) |

|---|---|---|---|---|---|

| 1994 | $7.200 | $281–292 | 3.9–4.1% | ~$4.650 | 64.6–65.2% |

| 1995 | 7.600 | 277–281 | 3.7% | ~4.950 | 64.8–65.6% |

| 1996 | 8.000 | 251–260 | 3.1–3.3% | ~5.200 | 65.0–65.4% |

| 1997 | 8.500 | 188 | 2.2% | ~5.400 | 63.2–63.8% |

| 1998 | 8.950 | 109–113 | 1.2–1.3% | ~5.500 | 61.2–61.8% |

| 1999 | 9.500 | 127–130 | 1.3–1.4% | 5.656 | 59.3% |

| 2000 | 10.150 | 18 | 0.2% | 5.674 | 55.8% |

| 2001 | $10.550 | $133 | 1.3% | $5.792 | 54.8% |

| 2002 | 10.900 | 421 | 3.9% | 6.213 | 57.1% |

| 2003 | 11.350 | 570 | 5.0% | 6.783 | 59.9% |

| 2004 | 12.100 | 596 | 4.9% | 7.379 | 61.0% |

| 2005 | 12.900 | 539 | 4.2% | 7.918 | 61.4% |

| 2006 | 13.700 | 575 | 4.2% | 8.493 | 62.1% |

| 2007 | 14.300 | 500 | 3.5% | 8.993 | 62.8% |

| 2008 | 14.750 | 1.018 | 6.9% | 10.011 | 67.9% |

| 2009 | $14.400 | $1.887 | 13.1% | $11.898 | 82.5% |

| 2010 | 14.800 | 1.653 | 11.2% | 13.551 | 91.6% |

| 2011[170] | 15.400 | 1.230 | 8.0% | 14.781 | 96.1% |

| 2012 | 16.050 | 1.278 | 8.0% | 16.059 | 100.2% |

| 2013 | 16.500 | 673 | 4.1% | 16.732 | 101.3% |

| 2014 | 17.200 | 1.078 | 6.3% | 17.810 | 103.4% |

| 2015 | 17.900 | 328 | 1.8% | 18.138 | 101.3% |

| 2016 (أكتوبر '15– يوليو '16 فقط) |

~1.290 | ~7.0% | ~19.428 | ~106.1% |

في 29 يوليو 2016، أصدر مكتب التحليل الاقتصادي (BEA) مراجعةً لأرقام الناتج المحلي الإجمالي للفترة 2013-2016. وقد صُحِّحت أرقام هذا الجدول في الأسبوع التالي مع التغييرات التي طرأت على أرقام تلك السنوات المالية.

في 30 يوليو 2015، أصدر مكتب التحليل الاقتصادي (BEA) مراجعةً لأرقام الناتج المحلي الإجمالي للفترة 2012-2015. وقد صُحِّحت أرقام هذا الجدول في ذلك اليوم مع تغييرات على بيانات السنتين الماليتين 2013 و2014، لكن ليس لعام 2015، إذ يتم تحديث بيانات السنة المالية 2015 خلال أسبوع مع إصدار إجمالي الديون في 31 يوليو 2015.

في 25 يونيو 2014، أعلن مكتب التحليل الاقتصادي (BEA) عن مراجعة لأرقام الناتج المحلي الإجمالي على مدى 15 عامًا، وذلك في 31 يوليو 2014. وقد صُحِّحت أرقام هذا الجدول بعد ذلك التاريخ، مع تغييرات على السنوات المالية 2000 و2003 و2008 و2012 و2013 و2014. وتُستمد أرقام الدين الأكثر دقة للسنوات المالية 1999-2014 من نتائج تدقيق وزارة الخزانة. أما الاختلافات في أرقام التسعينيات والسنة المالية 2015 فتعود إلى ازدواجية مصادر أو بيانات أولية نسبيًا للناتج المحلي الإجمالي على التوالي. نُشرت مراجعة شاملة للناتج المحلي الإجمالي بتاريخ 31 يوليو 2013 على موقع مكتب التحليل الاقتصادي. في نوفمبر 2013، تم تعديل أعمدة إجمالي الدين والدين السنوي كنسبة مئوية من الناتج المحلي الإجمالي في هذا الجدول لتعكس أرقام الناتج المحلي الإجمالي المُعدّلة.

المستويات التاريخية لسقف الدين

تخلص البنوك المركزية الأجنبية من السندات 2016

حكومات العالم تبيع 324 مليار $ سندات خزانة أمريكية - أكبر انخفاض من 1978

اليابان تصبح أكبر دائن للولايات المتحدة بقيمة 1.13 تريليون دولار، بعد أن تخلصت الصين من 40 مليار دولار من سندات الخزانة الأمريكية في ثلاث سنوات ليبلغ قيمة ما تملكه من سندات الخزانة الأمريكية 1.12 تريليون دولار. هذا لا يعني أن اليابان اشترت المزيد من السندات، بل على العكس فقد تخلصت من سندات قيمتها 4 مليار دولار. وقد أدى هذا الصدود إلى رفع الاحتياط الفدرالي لسعر الفائدة على السندات الخزانة الأمريكية من 1.366% في يوليو 2016 إلى 2.564% في ديسمبر 2016، ويُتوقع أن يصل 3% في غضون شهور. وبدلاً من أن يجتذب سعر الفائدة المرتفع مشترين صينيين، يتوقع الخبراء أن رفع سعر الفائدة سيجعل الصين تتخلص من المزيد من السندات! (وهو ما أراه معاكس للمنطق).[171]

انظر أيضاً

الولايات المتحدة

- اقتصاد الولايات المتحدة

- قانون الاستقرار الاقتصادي الطارئ 2008 – جزء من برنامج إغاثة الأصول المتعثرة

- الموقف المالي للولايات المتحدة

- تاريخ الدين العام للولايات المتحدة

- الدين القومي للولايات المتحدة حسب الفترات الرئاسية

- تجويع الوحش – قبل سياسي الضرائب/الميزانية في السبعينيات.

- الميزانية الفدرالية للولايات المتحدة

المصادر

- ^ "Historical Tables – Table 1.2 – Summary of Receipts, Outlays, and Surpluses or Deficits (-) as Percentages of GDP: 1930–2017" (PDF). Office of Management and Budget. Retrieved أبريل 16, 2012.

- ^ "Federal debt basics – How large is the federal debt?". Government Accountability Office. Archived from the original on July 6, 2011. Retrieved April 28, 2012.

- ^ About 0.8% of debt ($1009 billion) is not covered by the ceiling, per The Debt Limit: History and Recent Increases, p. 4. (Note: This includes pre-1917 debt), fpc.state.gov; accessed August 22, 2016.

- ^ "Federal debt basics – How large is the federal debt?". Government Accountability Office. Retrieved April 28, 2012.

- ^ "The 2014 Long-Term Budget Outlook in 26 Slides – Congressional Budget Office". cbo.gov.

- ^ About 0.8% of debt ($1009 billion) is not covered by the ceiling, per The Debt Limit: History and Recent Increases, p. 4. (Note: This includes pre-1917 debt), fpc.state.gov; accessed August 24, 2016.

- ^ https://www.newsweek.com/national-debt-could-surpass-25-trillion-amid-spending-combat-coronavirus-1493758

- ^ "Debt to the Penny". United States Department of the Treasury. Retrieved June 24, 2019.

- ^ https://fred.stlouisfed.org/series/FYGFGDQ188S.

{{cite web}}: Missing or empty|title=(help) - ^ https://www.treasurydirect.gov/govt/reports/pd/mspd/2018/opds122018.pdf

- ^ "2018 foreign investors".

- ^ أ ب "The World Factbook — Central Intelligence Agency". www.cia.gov. خطأ استشهاد: وسم

<ref>غير صالح؛ الاسم "cia.gov" معرف أكثر من مرة بمحتويات مختلفة. - ^ أ ب ت ث "The Budget and Economic Outlook: 2018 to 2028 – Congressional Budget Office". www.cbo.gov.

- ^ خطأ استشهاد: وسم

<ref>غير صحيح؛ لا نص تم توفيره للمراجع المسماةCRFB_CARES1 - ^ Rappeport, Alan (2022-02-01). "U.S. National Debt Tops $30 Trillion as Borrowing Surged Amid Pandemic". The New York Times (in الإنجليزية الأمريكية). ISSN 0362-4331. Retrieved 2022-02-02.

- ^ "Debt to the Penny". fiscaldata.treasury.gov. United States Department of the Treasury. Retrieved December 4, 2023.

- ^ "What is the national debt?". fiscaldata.treasury.gov. United States Department of the Treasury. Retrieved August 18, 2023.

- ^ "Foreign Holdings of Federal Debt" (PDF). Congressional Budget Office. May 25, 2022. Retrieved September 29, 2022.

- ^ "The 2022 Long-Term Budget Outlook" (in الإنجليزية). Congressional Budget Office. 2022-07-27. Retrieved 2022-09-30.

- ^ Fox, Michelle (March 1, 2024). "The U.S. national debt is rising by $1 trillion about every 100 days". CNBC. Retrieved March 1, 2024.

- ^ "Fiscal Data Explains the National Debt". fiscaldata.treasury.gov (in الإنجليزية). Retrieved 2025-02-27.

- ^ أ ب United States Congress, Government Accountability Office (November 5, 2004). Financial Audit: Bureau of the Public Debt's Fiscal Years 2004 and 2003 Schedules of Federal Debt GAO-05-116 United States Government Accountability Office (GAO). Retrieved January 16, 2011. خطأ استشهاد: وسم

<ref>غير صالح؛ الاسم "gao2004" معرف أكثر من مرة بمحتويات مختلفة. - ^ "Measuring the Deficit: Cash vs. Accrual". Government Accountability Office. Retrieved January 19, 2011.

- ^ United States Department of the Treasury, Bureau of the Public Debt (Oct 1, 2010). "Government – Historical Debt Outstanding – Annual 2000–2010" TreasuryDirect. Retrieved January 17, 2011.

- ^ "U.S. credit outlook cut by S&P on deficit concerns". New York. Reuters. April 18, 2011. Retrieved April 18, 2011.

"Because the U.S. has, relative to its AAA peers, what we consider to be very large budget deficits and rising government indebtedness, and the path to addressing these is not clear to us, we have revised our outlook on the long-term rating to negative from stable," S&P said in a release.

- ^ "Making dollars and sense of the U.S. government debt" (PDF). Retrieved Summer 18, 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ خطأ استشهاد: وسم

<ref>غير صحيح؛ لا نص تم توفيره للمراجع المسماةTreasPenny - ^ "U.S. Treasury Direct-February Monthly Statement of the Public Debt of the U.S." (PDF). Retrieved May 18, 2011.

- ^ "CBO Historical Tables – 1970 to 2010" (PDF). Retrieved May 18, 2011.

- ^ "Fiscal Data Explains the National Debt". fiscaldata.treasury.gov (in الإنجليزية). Retrieved 2025-02-27.

- ^ "The 2012 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds" (PDF). Ssa.gov. Retrieved 2016-08-27.

- ^ "Social Security Trust Fund 2010 Report Summary". Ssa.gov. Retrieved May 18, 2011.

- ^ "Federal debt basics – What is the difference between the two types of federal debt?". Government Accountability Office. Retrieved April 28, 2012.

- ^ "Measuring the Deficit: Cash vs. Accrual". Government Accountability Office. Retrieved January 19, 2011.

- ^ أ ب Barr, Colin (September 7, 2008). "Paulson readies the 'bazooka'", CNN.com; retrieved January 17, 2011. خطأ استشهاد: وسم

<ref>غير صالح؛ الاسم "agencies" معرف أكثر من مرة بمحتويات مختلفة. - ^ Timiraos, Nick (March 3, 2014). "Investor Fires Salvo Against Fannie, Freddie-Viewed March 2014". The Wall Street Journal. Retrieved August 24, 2016.

- ^ Fannie Mae, Freddie Mac to Be Kept Off Budget, White House Says (September 12, 2008), Bloomberg.com.

- ^ The case for keeping Fannie Mae and Freddie Mac off the government's books has gotten even weaker, professional.wsj.com (يتطلب اشتراك)

- ^ Timiraos, Nick (March 3, 2014). "Investor Fires Salvo Against Fannie, Freddie-Viewed March 2014". WSJ. Retrieved August 24, 2016.

- ^ أ ب Congress of the United States, Government Accountability Office (February 13, 2009). "The federal government's financial health: a citizen's guide to the 2008 financial report of the United States government", pp. 7–8. United States Government Accountability Office (GAO) [website]. Retrieved February 1, 2011.

- ^ Peter G. Peterson Foundation (April 2010). "Citizen's guide 2010: Figure 10 p. 16". Peter G. Peterson Foundation website; retrieved February 5, 2011.

- ^ "Government – Debt Position and Activity Report". www.treasurydirect.gov.

- ^ "Historical Tables of the FY 2009 Budget" (PDF). Retrieved May 18, 2011.

- ^ Social Security Trust Fund Report, p. 19

- ^ "U.S. National Debt Clock". Brillig.com. September 28, 2007. Retrieved May 18, 2011.

- ^ 2010 Budget-Summary Tables S-13 and S-14[dead link]

- ^ "President's Radio Address – May 16, 2009". Whitehouse.gov. Retrieved May 18, 2011.

- ^ "Samuelson – Risky Deficit Spending". Realclearmarkets.com. May 18, 2009. Retrieved May 18, 2011.

- ^ "CIA Factbook 2008". Cia.gov. November 20, 2010. Retrieved May 18, 2011.

- ^ "Embargoed Until 2 pm" (PDF). Retrieved May 18, 2011.

- ^ Multiple references:

- Debt to the Penny (Daily History Search Application) Archived أبريل 18, 2011 at the Wayback Machine

- US national debt surpasses $16 trillion – Boston Business Journal

- United States Department of the Treasury, Bureau of the Public Debt (December 2010). "The debt to the penny and who holds it". TreasuryDirect. Retrieved August 26, 2012.

- ^ Table 1.1 – Summary of Receipts, Outlays, and Surpluses or Deficits (-): 1789–2017 Whitehouse.gov

- ^ "CBO Budget and Economic Outlook 2009–2019". CBO. January 7, 2009. Retrieved November 21, 2016.

- ^ "TreasuryDirect Historical Debt Outstanding". Treasury Direct. Archived from the original on May 8, 2019. Retrieved November 26, 2016.

- ^ أ ب "Money in budgets, but supplementals aren't going away". PolitiFact. Retrieved November 26, 2016.

- ^ "Debt to the Penny". U.S. Treasury Fiscal Data (in الإنجليزية). Retrieved 2022-08-23.

- ^ "Treasury Direct-Monthly Statement of the Public Debt Held by the U.S." (PDF). September 2014. Archived from the original (PDF) on October 26, 2014. Retrieved November 30, 2014.

- ^ Marc Labonte; Jared C. Nagel (July 9, 2021). Foreign Holdings of Federal Debt. Congressional Research Service. p. ii. Archived from the original. You must specify the date the archive was made using the

|archivedate=parameter. https://fas.org/sgp/crs/misc/RS22331.pdf. Retrieved on July 21, 2021. - ^ "Major Foreign Holders of Treasury Securities". U.S. Department of Treasury. Retrieved November 30, 2014.

- ^ "Major Foreign Holders of Treasury Securities". U.S. Department of Treasury. Retrieved July 19, 2011.

- ^ Whitehouse, Steve (June 30, 2008). "BIS says global downturn could be 'deeper and more protracted' than expected". Forbes. Archived from the original on June 1, 2010. Retrieved January 22, 2011-Thomson Financial News

{{cite news}}: CS1 maint: postscript (link) - ^ tf.TFN-Europe_newsdesk (May 20, 2007). "Kuwait pegs dinar to basket of currencies". Forbes. Archived from the original on October 10, 2008. Retrieved January 22, 2011-AFX News

{{cite news}}: CS1 maint: postscript (link)[dead link] - ^ Fattah, Zainab and Brown, Matthew (June 4, 2007). "Syria to end dollar peg, 2nd Arab country in 2 weeks (update3)". Bloomberg. Retrieved November 4, 2007.

{{cite news}}: CS1 maint: multiple names: authors list (link) - ^ "IMF takes up gold sales to expand lending" (September 18, 2009) NewsLibrary.com. Retrieved January 22, 2011 (archived; $1.50 charge to view article).

- ^ "China won't dump US Treasuries or pile into gold". China Daily eClips. July 7, 2010. Retrieved July 18, 2010.

- ^ Krugman, Paul (2012-01-01). "Nobody Understands Debt". New York Times. Retrieved 2012-02-04.

- ^ Orzag, Peter R. (June 17, 2008). "The long-term budget outlook and options for slowing the growth of health care costs". Testimony: Statement of Peter R. Orzag, Director, before the Committee on Finance United States Senate. Retrieved February 5, 2011.

- ^ أ ب "GAO-08-446CG U.S. Financial Condition and Fiscal Future Briefing, presented by the Honorable David M. Walker, Comptroller General of the United States: The National Press Foundation, Washington, D.C.: January 17, 2008" (PDF). Retrieved May 18, 2011.

- ^ "The Nation's Long-Term Fiscal Outlook: September 2008 Update". Gao.gov. September 29, 2008. Retrieved May 18, 2011.

- ^ Saint Louis Federal Reserve (2012) "5-Year Treasury Inflation-Indexed Security, Constant Maturity" FRED Economic Data chart from government debt auctions (the x-axis at y=0 represents the inflation rate over the life of the security)

- ^ أ ب Carmen M. Reinhart and M. Belen Sbrancia (March 2011) "The Liquidation of Government Debt" National Bureau of Economic Research working paper No. 16893

- ^ David Wessel (August 8, 2012) "When Interest Rates Turn Upside Down" Wall Street Journal (full text)

- ^ Lawrence Summers (June 3, 2012) "Breaking the negative feedback loop" Reuters

- ^ Matthew Yglesias (May 30, 2012) "Why Are We Collecting Taxes?" Slate

- ^ William H. Gross (May 2, 2011) "The Caine Mutiny (Part 2)" PIMCO Investment Outlook

- ^ "Why the U.S. Government Never, Ever Has to Pay Back All Its Debt" The Atlantic, February 1, 2013

- ^ Ambrose Evans-Pritchard (October 21, 2012) "IMF's epic plan to conjure away debt and dethrone bankers" The Telegraph

- ^ Jaromir Benes and Michael Kumhof (August 2012) "The Chicago Plan Revisited" International Monetary Fund working paper WP/12/202

- ^ "Debt-Deflation versus the Liquidity Trap: the Dilemma of Nonconventional Monetary Policy" CNRS, CES, Paris School of Economics, ESCP-Europe, October 23, 2012

- ^ "Credit and debt in Economic Theory: Which Way forward?" “Economics of Credit and Debt workshop, November 2012

- ^ "The economic crisis: How to stimulate economies without increasing public debt", Centre for Economic Policy Research, August 2012

- ^ أ ب Huntley, Jonathan (July 27, 2010). "Federal debt and the risk of a fiscal crisis". Congressional Budget Office: Macroeconomic Analysis Division. Retrieved February 2, 2011.

- ^ Goldman, David (November 16, 2009). "CNNMoney.com's bailout tracker". CNNMoney.com. Retrieved February 2, 2010.

- ^ Lynch, David J. (Mar 21, 2013). "Economists See No Crisis With U.S. Debt as Economy Gains". Bloomberg. Retrieved 25 March 2013.

- ^ U.S. House of Representatives Republican Caucus (May 27, 2010). "The perils of rising government debt". Republican Caucus Committee on the Budget [website]. Retrieved February 2, 2011.

- ^ أ ب Krugman, Paul (May 27, 2010). "Bad analysis at the deficit commission". The New York Times: The Opinion Pages: Conscience of a Liberal Blog. Retrieved February 9, 2011.

- ^ Vikas Bajaj (April 17, 2013) "Does High Debt Cause Slow Growth?", The New York Times Retrieved May 7, 2013.

- ^ Matthew O'Brien, "Forget Excel: This Was Reinhart and Rogoff's Biggest Mistake", The Atlantic

- ^ Herndon, Thomas. "Herndon Responds To Reinhart Rogoff". Business Insider. Retrieved 22 April 2013.

- ^ Weisenthal, Joe. "Reinhart And Rogoff Admit Excel Blunder". Business Insider. Retrieved 22 April 2013.

- ^ Herndon, Thomas, Michael Ash, and Robert Pollin, "Does High Public Debt Consistently Stifle Economic Growth? A Critique of Reinhart and Rogoff," University of Massachusetts – Amherst Department of Economics, April 15, 2013.

- ^ FT Data, "Reinhart-Rogoff recrunch the numbers," April 17, 2013.

- ^ NYT-Binyamin Appelbaum-Predicting a Crisis, Repeatedly-February 22, 2013

- ^ Greenlaw, Hamilton, Hooper, Mishkin Crunch Time: Fiscal Crises and the Role of Monetary Policy-February 2013

- ^ The Atlantic-No, the United States Will Never, Ever Turn Into Greece-Mathew O'Brien-March 7, 2013

- ^ Bernanke, Ben S. (April 27, 2010). "Speech before the National Commission on Fiscal Responsibility and Reform: Achieving fiscal sustainability". Federalreserve.gov. Retrieved February 2, 2011.

- ^ Reuters-Highlights: Bernanke on the economy, monetary policy-Retrieved January 2013

- ^ Bittle, Scott & Johnson, Jean (2008). Where Does the Money Go? New York: Collins. ISBN 978-0-06-124187-1.

- ^ Bernanke, Ben S. (October 4, 2006). "The coming demographic transition: Will we treat future generations fairly?" Federalreserve.gov. Retrieved February 3, 2011

- ^ Court, Andy (July 8, 2007). "U.S. heading for financial trouble?". CBS News. Retrieved February 3, 2011.

- ^ أ ب United States Congress, Government Accountability Office (December 17, 2007). FY 2007 Financial Report of the U.S. Government, p. 47, et al. www.gao.gov. Retrieved February 3, 2011.

- ^ Greenspan, Alan (June 18, 2010). "U.S. Debt and the Greece analogy". Opinion Journal [online]. Retrieved February 3, 2011.

- ^ GAO-Financial Audit-Bureau of the Public Debt’s Fiscal Years 2012 and 2011 Schedules of Federal Debt-November 2012

- ^ Ferguson, Niall (November 3, 2009). "Interview with Charlie Rose". Charlie Rose [website]. Retrieved February 6, 2011.

- ^ أ ب Horney, James R. (May 27, 2010). "Recommendation that president’s fiscal commission focus on gross debt is misguided". Center on Budget and Policy Priorities [website]. Retrieved February 9, 2011.

- ^ United States Treasury, Bureau of the Public Debt (April 30, 2010). "Monthly statement of public debt of the United States". TreasuryDirect. Retrieved February 9, 2011.

- ^ "CBO-Social Security Policy Options-July 2010" (PDF). Retrieved May 18, 2011.

- ^ WSJ-A Short Primer on the National Debt-John Steele Gordon-August 2011

- ^ أ ب NYT-Paul Krugman-Debt is Mostly Money We Owe Ourselves-December 2011

- ^ Professor G. William Domhoff-Who Rules America?-Sociology Department-University of California Santa Cruz-Retrieved March 2013

- ^ Dean Baker-Center for Economic and Policy Research-David Brooks is Projecting His Self Indulgence Again-December 2011

- ^ NYT-Paul Krugman-Cheating our Children-March 2013

- ^ P.L. 65-43, 40 Stat. 288, enacted September 24, 1917, Currently codified as amended as 31 U.S.C. § 3101.

- ^ American Prospect-Debt Ceiling 101-Retrieved January 2013

- ^ "Public Debt Acts: Major Acts of Congress". Enotes.com. Retrieved 2011-08-07.

- ^ "A Brief History of the U.S. Federal Debt Limit". Freegovreports.com. 2010-01-28. Retrieved 2011-08-07.

- ^ Government Accountability Office (February 22, 2011). "Debt Limit: Delays Create Debt Management Challenges and Increase Uncertainty in the Treasury Market".

- ^ Lowrey, Annie (May 16, 2011). "Debt ceiling crisis: The debt ceiling is a pointless, dangerous relic, and it should be abolished". Slate. Retrieved August 1, 2011.

- ^ Epstein, Jennifer (July 18, 2011). "Moody's: Abolish the debt limit". Politico. Retrieved August 1, 2011.

- ^ Gail Russell Chaddock (January 4, 2010). "Repeal of the Gephardt rule". Christian Science Monitor.

- ^ Timothy Geithner (April 4, 2011). "Geithner Letter to Congress". Treasury Department.

- ^ "U.S. National Debt Tops Debt Limit". CBS News. Retrieved August 1, 2011.

- ^ Simon Rodgers (January 3, 2012). "US debt ceiling: how big is it and how has it changed?". the guardian.

- ^ H.J.Res. 45

- ^ "Bill Summary & Status – 111th Congress (2009–2010) – H.J.RES.45 – CRS Summary – THOMAS (Library of Congress)". Thomas.loc.gov. February 4, 2010. Retrieved August 3, 2011.

- ^ Spetalnick, Matt (February 12, 2010). "Obama signs debt limit-paygo bill into law". Reuters. Retrieved July 28, 2011.

- ^ Senate sinks debt-ceiling disapproval bill

- ^ Koba, Mark. "What is the 'Fiscal Cliff?'". CNBC.com. CNBC.com. Retrieved 12 November 2012.

- ^ أ ب United States Department of the Treasury, Bureau of the Public Debt (2010). "Government – Historical Debt Outstanding – Annual" Archived ديسمبر 6, 2020 at the Wayback Machine, TreasuryDirect.gov; retrieved January 16, 2011.

- ^ أ ب The Executive Office of the President of the United States, Office of Management and Budget (April 10, 2013). "Federal debt at the end of year: 1940–2018"; "Gross domestic product and deflators used in the historical tables: 1940–2018", Budget of the United States Government: Fiscal Year 2014: Historical Tables, pp. 143–44, 215–16, Government Printing Office website; retrieved November 27, 2013.

- ^ The Executive Office of the President of the United States, Office of Management and Budget (February 14, 2010). "Historical Tables: Table 7-1; 10-1", The White House; retrieved February 15, 2010.

- ^ أ ب United States Department of Commerce, Bureau of Economic Analysis. "National Economic Accounts: Gross Domestic Product: Current-dollar and 'real' GDP", BEA.gov; retrieved August 3, 2011.

- ^ Frank H. Vizetelly; Litt.D., LL.D., eds. (1999). "DEBT, National". New Standard Encyclopedia of Universal Knowledge. Vol. Eight. New York and London: Funk and Wagnalls Company. p. 471.

Debt of Principal Nations and Aggregate for All Nations of the World at Various Dates (in millions of dollars): '1928 ... ... .18,510'

- ^ أ ب ت ث ج ح GAO-Financial Audit-Bureau of the Fiscal Service's FY 2019 and FY 2018 Schedules of Federal Debt Archived نوفمبر 12, 2020 at the Wayback Machine, treasurydirect.gov, November 2019.

- ^ "Gross Domestic Product, 2nd quarter 2018 (advance estimate), and comprehensive update | U.S. Bureau of Economic Analysis (BEA)". www.bea.gov.

- ^ MeasuringWorth.com (December 14, 2010) "What was the U.S. GDP then?", MeasuringWorth.com; retrieved January 30, 2011.

- ^ United States Congress, Government Accountability Office (March 1, 2001). Financial Audit: Bureau of the Public Debt's Fiscal Years 2000 and 1999 Schedules of Federal Debt GAO-01-389 United States Government Accountability Office (GAO); retrieved August 6, 2012.