قانون الامتثال الضريبي للحسابات الأجنبية

| |

|---|---|

| الاختصار | FATCA |

| فرضه | الكونگرس 111 |

| ساري منذ | March 18, 2010 (26 USC §6038D); December 31, 2012 (26 USC §§1471-1474) |

| الذِكر | |

| قانون عام | 111-147 |

| Stat. | 124 Stat. 97-117 |

| التقنين | |

| العنوان عـُدِّل | 26 |

| أقسام أُنشئت في U.S.C. | 26 USC §§ 1471-1474, 26 USC § 6038D |

| أقسام من U.S.C. عُدِّلت بشكل كبير | 26 USC §§ 163, 643, 679, 871, 1291, 1298, 4701, 6011, 6501, 6662, 6677 |

| |

| التعديلات الرئيسية | |

| قضايا أمام المحكمة العليا ذات صلة | |

قانون الامتثال الضريبي للحسابات الأجنبية Foreign Account Tax Compliance Act (فاتكا FATCA)، هو قسم من Hiring Incentives to Restore Employment (HIRE) Act الذي يلزم من الأفراد تقديم تقرير بحساباتهم المالية الموجودة خارج الولايات المتحدة ومن المؤسسات المالية الأجنبية تقديم تقرير عن عملائها الأمريكيين إلى دائرة الايرادات الداخلية. تم تصميم هذا القانون بصفة أساسية لمكافحة التهرب الضريبي واسترداد العائدات الضريبية الفدرالية.[1][2]

ويخول هذا القانون للسلطات الضريبية الأمريكية والمتمثلة في مصلحة الضرائب ملاحقة الأمريكيين المكلفين بسداد الضرائب خارج حدود الدولة، باستخدام النظام المصرفي العالمي.[3] وفي حالة عدم تنفيذ البنوك العربية لقانون الفاتكا أو عدم تعاونها مع السلطات الأمريكية، يسمح القانون لمصلحة الضرائب باقتطاع 30% من التحويلات الجارية بواسطة المصارف الأمريكية من حسابات المصرف العربي، الذى لا يلتزم بالتصريح عن عميله حامل الجنسية وفق لوائح الخزانة الأمريكية، ولا يسرى هذه القانون على حسابات الأشخاص أو الشركات التى تقل أرصدتهم عن 50 ألف دولار.

خلفية

FATCA was reportedly enacted for the purpose of detecting the non-U.S. financial accounts of U.S. resident taxpayers rather than to identify non-resident U.S. citizens and enforce collections.[4] However, although there might be thousands of resident U.S. citizens with non-U.S. assets, such as investors, dual citizens, or legal immigrants,[5] FATCA also applies to the estimated 5.7 to 9 million U.S. citizens residing outside of the United States[6][7] and those persons believed to be U.S. persons for tax purposes.[8][9] FATCA also affects non-U.S.-person family members and business partners who share accounts with U.S. persons or who have U.S.-person signatories of accounts. This feature allows the reporting of the assets of non-U.S. corporations, volunteer organisations, and any other non-U.S. entity where a U.S. person can be identified.

البنود

البنود الثلاثة الرئيسية في الفاتكا:

- قانون الإلتزام بقواعد الضرائب على الحسابات الأمريكية خارج الولايات المتحدة(FATCA) والذي تم سنه عام 2010 كجزء من قانون حوافز التوظيف الأمريكي “HIRE Act” يعد خطوة أساسية في الجهود الأمريكية لمواجهة التهرب الضريبي الذي يتم من جانب أشخاص أمريكيين يحتفظون باستثمارات في حسابات بنكية خارج الولايات المتحدة الأمريكية, وقد صدر بشكل نهائي في 17 يناير 2013، كما تم نشره في 28 يناير 2013.

- بموجب أحكام قانون فاتكا يتعين على كافة المؤسسات المالية – سواء التي تمارس أعمالها داخل الولايات المتحدة الأمريكية أو خارجها – أن تقوم بتصنيف عملائها إلي شريحتين الأولي للعملاء الأمريكيين والثانية لغير الأمريكيين. وسوف يطالب القانون المؤسسات المالية الأجنبية بتقديم تقارير بصورة مباشرة إلى مصلحة ضريبة الدخل الأمريكية (IRS) على أن تتضمن هذه التقارير معلومات محددة عن الحسابات المالية التي يحتفظ بها دافعو الضرائب الأمريكيين أو الكيانات الأجنبية التي يمتلك فيها دافعو الضرائب الأمريكيين حصص ملكية. جوهرية.

- بمقتضى قانون فاتكا فإنه سيتعين على بعض دافعي الضرائب الأمريكيين الذين يمتلكون أصولاً مالية خارجية تتجاوز قيمتها الإجمالية مبلغ 50 ألف دولار أمريكي تقديم بيان يتضمن معلومات معينة بخصوص تلك الأصول من خلال نموذج جديد والذي يجب إرفاقه بالإقرار الضريبي السنوي لدافع الضرائب. عدم الإبلاغ عن الأصول المالية الخارجية من خلال النموذج سيؤدي للتعرض لغرامة تبلغ 10.000 دولار (وغرامة تصل إلى 50.000 دولار نتيجة الإستمرار في عدم الإبلاغ بعد إخطار مصلحة الضرائب). علاوة على ذلك، فإن المبالغ التي لم تسدد للضرائب نتيجة عدم الإفصاح عن الأصول المالية الخارجية ستخضع لغرامة إضافية كبيرة تصل إلى 40%.

جدل

التكاليف

الإنفاذ

الإنفاذ على المستوى المحلي

التعاون بين الحكومات

الاتفاقيات بين الحكومات

As enacted by Congress, FATCA was intended to form the basis for a relationship between the U.S. Department of the Treasury and individual foreign banks. Some FFIs responded[10] however, that it was not possible for them to follow their own countries' laws on privacy, confidentiality, discrimination, and so on and simultaneously comply with FATCA as enacted.[11][12] Discussions[من؟] with and among financial industry lobbyists resulted in the Intergovernmental Agreements (IGA's) between the Executive Branch of the United States government with foreign governments.[13] This development resulted in foreign governments implementing the US FATCA requirements into their own legal systems, which in turn allowed those governments to change their privacy and discrimination laws[14] to allow the identification and reporting of US persons via those governments.[14]

The United States Department of the Treasury has published model IGAs which follow two approaches. Under Model 1, financial institutions in the partner country report information about U.S. accounts to the tax authority of the partner country. That tax authority then provides the information to the United States. Model 1 comes in a reciprocal version (Model 1A), under which the United States will also share information about the partner country's taxpayers with the partner country, and a nonreciprocal version (Model 1B). Under Model 2, partner country financial institutions report directly to the U.S. Internal Revenue Service, and the partner country agrees to lower any legal barriers to that reporting.[15] Model 2 is available in two versions: 2A with no Tax Information Exchange Agreement (TIEA) or Double Tax Convention (DTC) required, and 2B for countries with a pre-existing TIEA or DTC. The agreements generally require parliamentary approval in the countries they are concluded with, but the United States is not pursuing ratification of this as a treaty.

In April 2014, the U.S. Department of the Treasury and IRS announced that any jurisdictions that reach "agreements in substance" and consent to their compliance statuses being published by the July 1, 2014, deadline would be treated as having an IGA in effect through the end of 2014, ensuring no penalties would be incurred during that time while giving more jurisdictions an opportunity to finalize formal IGAs.[16][15]

In India the Securities and Exchange Board of India (SEBI) said "FATCA in its current form lacks complete reciprocity from the US counterparts, and there is an asymmetry in due-diligence requirements." Furthermore, "Sources close to the development say the signing has been delayed because of Indian financial institutions' unpreparedness."[17]

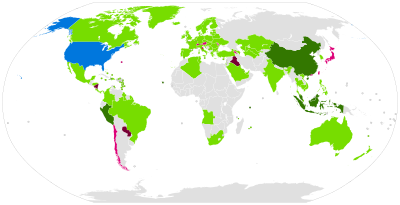

With Canada's agreement in February 2014, all G7 countries have signed intergovernmental agreements. As of November 2019, the following jurisdictions have concluded intergovernmental agreements with the United States regarding the implementation of FATCA, most of which have entered into force.[15]

| Jurisdiction | Model | Signature | Entry into force | Approval process partner state |

|---|---|---|---|---|

| 1 | October 13, 2015 | January 18, 2017 | ||

| 1 | November 9, 2015 | October 2, 2017 | ||

| 1 | January 15, 2017 | June 22, 2017 | ||

| 1 | August 31, 2016 | June 7, 2017 | ||

| 2 | February 12, 2018 | July 7, 2019 | ||

| 1 | April 28, 2014 | June 30, 2014[18] | ||

| 2 | April 29, 2014 | December 9, 2014[19] | ||

| 1 | September 9, 2015 | November 5, 2015[20] | ||

| 1 | November 3, 2014 | September 17, 2015[20] | ||

| 1 | January 18, 2017 | March 5, 2018 | ||

| 1 | November 17, 2014 | September 25, 2015[20] | ||

| 1 | March 18, 2015 | July 29, 2015[20] | ||

| 1 | April 23, 2014 | December 23, 2016 | ||

| 2 | December 19, 2013 | August 19, 2014[19] | ||

| 1 | September 23, 2014 | June 26, 2015 | ||

| 1 | June 30, 2014 | July 13, 2015 | ||

| 1 | December 5, 2014 | June 30, 2015[20] | ||

| 1 | September 14, 2015 | December 23, 2016 | ||

| 1 | February 5, 2014 | June 27, 2014[21] | Implementation act published.[22] | |

| 1B[23] | November 29, 2013 | July 1, 2014[19] | ||

| 2 | March 5, 2014 | |||

| 1 | May 20, 2015 | August 27, 2015 | ||

| 1A[23] | November 26, 2013 | July 8, 2019 | ||

| 1 | March 20, 2015 | December 27, 2016 | ||

| 1 | December 16, 2014 | August 3, 2016 | ||

| 1 | December 2, 2014 | September 21, 2015 | ||

| 1 | August 4, 2014 | December 18, 2014 | ||

| 1 | November 19, 2012 | September 30, 2015[20] | Implementation law L67 passed December 20, 2013.[24] Draft implementation regulation published, hearing ends May 8, 2014.[25] Due diligence deadlines June 30, 2015, and June 30, 2016.[26] | |

| 1 | June 15, 2018 | August 12, 2019 | ||

| 1 | September 15, 2016 | July 17, 2019 | ||

| 1 | April 11, 2014 | July 9, 2014[19] | ||

| 1 | March 5, 2014 | February 20, 2015[20] | ||

| 1 | November 14, 2013 | October 14, 2014[19] | ||

| 1 | July 10, 2015 | September 18, 2015 | ||

| 1 | May 31, 2013 | December 11, 2013[27] | ||

| 1 | May 8, 2014 | September 17, 2015[20] | ||

| 1 | January 19, 2017 | December 13, 2017 | ||

| 1 | January 17, 2017 | November 30, 2018 | ||

| 1 | October 17, 2016 | April 6, 2018 | ||

| 1 | December 13, 2013 | August 26, 2015 | Draft implementation regulation published.[28] | |

| 1 | August 29, 2016 | September 29, 2017 | ||

| 1 | March 31, 2014 | February 19, 2015[20] | ||

| 2 | November 13, 2014 | July 6, 2016 | ||

| 1 | February 4, 2014 | July 16, 2014[19] | ||

| 1 | May 26, 2015 | September 22, 2015[20] | ||

| 1 | July 9, 2015 | August 31, 2015[20] | ||

| 1 | January 23, 2013 | April 2, 2014 | ||

| 1 | December 13, 2013 | August 26, 2015 | Draft implementation regulation published.[28] | |

| 1 | June 30, 2014 | August 29, 2016 | ||

| 1 | January 10, 2014 | August 17, 2015[20] | ||

| 1 | May 2, 2014 | September 24, 2015 | ||

| 2 | June 11, 2013 | June 11, 2013 | ||

| 1 | December 13, 2013 | October 28, 2015[20] | Draft implementation regulation published.[28] | |

| 1 | September 11, 2017 | |||

| 1 | February 26, 2015 | November 4, 2015 | ||

| 1 | April 29, 2015 | January 28, 2016 | ||

| 1 | June 27, 2014 | December 15, 2014[19] | ||

| 1 | May 19, 2014 | January 22, 2015[20] | ||

| 1 | August 26, 2014 | October 7, 2014 | ||

| 1 | March 28, 2014 | July 29, 2015[20] | ||

| 2 | December 14, 2016 | |||

| 1A[29] | December 16, 2013 | June 26, 2014[19] | ||

| 1 | December 27, 2013 | August 29, 2014[19] | ||

| 1 | November 19, 2012 | January 1, 2013[30] | Replaced by revised treaty on April 9, 2014, with no break in enforcement.[31] | |

| 2 | November 26, 2014 | January 21, 2016 | ||

| 1 | June 1, 2017 | March 28, 2018 | ||

| 1 | September 8, 2015 | October 28, 2016 | ||

| 1A[32][33] | December 18, 2013 | April 9, 2015[34] | ||

| 1 | June 12, 2014 | July 3, 2014[35] | ||

| 1 | April 15, 2013 | January 27, 2014[19] | ||

| 1 | April 27, 2016 | October 25, 2016 | ||

| 1 | July 13, 2015 | |||

| 1 | October 7, 2014 | July 1, 2015 | ||

| 1 | August 6, 2015 | August 10, 2016 | ||

| 1 | January 7, 2015 | June 23, 2015[20] | ||

| 1 | May 28, 2015 | November 3, 2015 | ||

| 1 | August 31, 2015 | April 28, 2016 | ||

| 1 | November 19, 2015 | September 1, 2016 | ||

| 1 | August 18, 2015 | May 13, 2016 | ||

| 2 | October 28, 2015 | August 30, 2016 | ||

| 1 | November 15, 2016 | February 28, 2017 | ||

| 1 | April 10, 2019 | |||

| 1 | July 1, 2019 | |||

| 1 | December 9, 2014 | March 28, 2015 | Replaced by another agreement on November 18, 2018.[36] | |

| 1 | July 31, 2015 | November 9, 2015 | ||

| 1 | June 2, 2014 | July 1, 2014[19] | ||

| 1 | June 9, 2014 | October 28, 2014[19] | ||

| 1 | June 10, 2015 | September 8, 2016 | ||

| 1 | May 14, 2013 | December 9, 2013[37] | ||

| 1 | August 8, 2014 | March 1, 2015 | ||

| 2[38] | February 14, 2013 | June 2, 2014[39] | Parliamentary approval obtained;[40] insufficient supporters for a referendum.[41] | |

| 2 | December 22, 2016 | |||

| 1 | March 4, 2016 | |||

| 1 | August 19, 2016 | September 22, 2017 | ||

| 1 | May 13, 2019 | September 9, 2019 | ||

| 1 | July 29, 2015 | |||

| 1 | July 28, 2017 | November 6, 2017 | ||

| 1 | December 1, 2014 | July 25, 2016 | ||

| 1 | February 7, 2017 | November 18, 2019 | ||

| 1 | June 17, 2015 | February 19, 2016 | ||

| 1A | September 12, 2012 | August 11, 2014[أ] | ||

| 1 | April 3, 2015 | July 7, 2017 | ||

| 1 | June 10, 2015 | June 10, 2015[20] | ||

| 1 | April 1, 2016 | July 7, 2016 |

- ^ In the UK, formal approval of treaties before ratification is not requirement, although according to the Constitutional Reform and Governance Act 2010, they need to be presented to Parliament with an explanatory memorandum, which the government did in September 2012.

The following jurisdictions have also reached "agreements in substance":[15]

|

Model 1 |

Model 1 |

Model 2 |

انظر أيضاً

- ملاذ ضريبي Tax haven

- European Union withholding tax

- الولاية القضائية الأمريكية في الخارج

- تقرير معاملة مالية Currency transaction report

المصادر

- ^ "The Foreign Account Tax Compliance Act (FATCA)" (PDF). DLA Piper.

- ^ 111 Cong. Rec. S1635-36 (daily ed. Mar. 17, 2010) (statement of Sen. Levin) ("Right now, thousands of U.S. tax dodgers conceal billions of dollars in assets within secrecy-shrouded foreign banks, dodging taxes and penalizing those of us who pay the taxes we owe. The Permanent Subcommittee on Investigations... estimated that these tax-dodging schemes cost the Federal Treasury $100 billion a year.") [hereinafter "Levin statement"], http://www.gpo.gov/fdsys/pkg/CREC-2010-03-17/pdf/CREC-2010-03-17-pt1-PgS1633-8.pdf#page=4

- ^ "مصر لم تقرر الجهة التى توقع على قانون «الفاتكا» الأمريكى". جريدة الشروق المصرية. 2013-04-13ا3. Retrieved 2013-10-28.

{{cite web}}: Check date values in:|date=(help) - ^ Crassweller, Kary; Andrew C. Liazos, Todd A. Solomon, McDermott Will & Emery (22 March 2013). "What You Need to Know About Foreign Account Tax Compliance Act's (FATCA) Impact on Non-U.S. Retirement Plans". The National Law Review. ISSN 2161-3362. Retrieved 19 March 2014. (According to one commentator, Congress enacted FATCA "to make it more difficult for U.S. taxpayers to conceal assets held in offshore accounts")

- ^ 111 Cong. Rec. S1635-36 (daily ed. Mar 17, 2010) (statement of Sen. Levin) ("Right now, thousands of U.S. tax dodgers conceal billions of dollars in assets within secrecy-shrouded foreign banks, dodging taxes and penalizing those of us who pay the taxes we owe. The Permanent Subcommittee on Investigations... estimated that these tax-dodging schemes cost the Federal Treasury $100 billion a year.")

- ^ Overseas Citizen Population Analysis, Federal Voting Assistance Program, February 2016.

- ^ CA by the numbers Archived سبتمبر 14, 2017 at the Wayback Machine, Bureau of Consular Affairs, May 2017.

- ^ "What is a US Person for IRS tax purposes? - US Tax & Financial Services".

- ^ "Classification of Taxpayers for U.S. Tax Purposes". Internal Revenue Service.

- ^ "UPPSATSER.SE: Foreign Account Tax Compliance Act : - om USA:s extraterritoriella rättstillämpning och lagens förenlighet med svensk banksekretess".

- ^ TEXT OF THE FATCA COMMENT LETTER SUBMITTED BY AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED, 7 June 2011

- ^ ""the US legislation prima facie breaches New Zealand privacy and tax laws, which will" p15, The Treasury Budget 2014 Information Release Release Document, July 2014" (PDF). Archived from the original (PDF) on November 21, 2015. Retrieved September 19, 2015.

- ^ "FATCA FAQ". Archived from the original on March 2, 2016. Retrieved February 12, 2016.

- ^ أ ب http://uu.diva-portal.org/smash/get/diva2:792177/FULLTEXT01.pdf

- ^ أ ب ت ث "U.S. Treasury FATCA Resource Center". U.S. Treasury Department.

- ^ خطأ استشهاد: وسم

<ref>غير صحيح؛ لا نص تم توفيره للمراجع المسماةin-substance - ^ Upadhyay, Jayshree P. "Sebi flags down govt on India-US tax pact".

- ^ "Australia-US Intergovernmental Agreement (IGA) to improve international tax compliance and to implement FATCA (the US Foreign Account Tax Compliance Act)". Australia Department of the Treasury. Archived from the original on أغسطس 6, 2017. Retrieved يوليو 9, 2014.

- ^ أ ب ت ث ج ح خ د ذ ر ز س "2014 Treaties and Agreements". United States Department of State.

- ^ أ ب ت ث ج ح خ د ذ ر ز س ش ص ض ط ظ "2015 Treaties and Agreements". United States Department of State.

- ^ "Entry into Force of the Information Exchange Agreement between Canada and the United States". Department of Finance Canada. July 2, 2014.

- ^ "Legislative Proposals Relating To the Canada–United States Enhanced Tax Information Exchange Agreement". Department of Finance, Canada. Retrieved March 5, 2014.

- ^ أ ب "Bilateral Pacts Represent First FATCA Agreements in the Caribbean". Tax Analysts. November 29, 2013. Retrieved December 3, 2013.

- ^ "L 67 - Forslag til lov om ændring af skattekontrolloven og forskellige andre love. (Indberetning og automatisk udveksling af skatterelevante oplysninger om finansielle konti samt ophævelse af bagatelgrænser for ind- og udbetalinger m.v)". Folketinget.

- ^ "Høringsdetaljer - Høringsportalen".

- ^ PricewaterhouseCoopers. "Dansk lov om FATCA".

- ^ "Treaties in Force 2014" (PDF). United States Department of State.

- ^ أ ب ت "TAXATION (International Tax Compliance) (Crown Dependency [CD]) Regulations 2014, Guidance notes" (PDF). January 31, 2014. Retrieved March 6, 2014.

- ^ "2013 TNT 243-24 MALTA ANNOUNCES SIGNING OF FATCA AGREEMENT WITH U.S.". Tax Analysts. December 18, 2013.

{{cite web}}: Missing or empty|url=(help) - ^ U.S.-Mexico FATCA agreement Article 10(1) "The Agreement shall enter into force on January 1st, 2013 and shall continue in force until terminated."

- ^ 2nd U.S.-Mexico FATCA agreement Article 10(1)

- ^ https://www.webcitation.org/6WIDVMV0W?url=http://www.treasury.gov/resource-center/tax-policy/treaties/Documents/FATCA-Agreement-Netherlands-12-18-2013.pdf?

- ^ "Agreement between the United States of America and the Kingdom of the Netherlands to Improve International Tax Compliance and to Implement FATCA" (PDF).

- ^ "Briefwisseling tussen Nederland en de VS". Government of the Netherlands. April 28, 2015. Retrieved April 28, 2015.

- ^ "Foreign Account Tax Compliance Act (FATCA) - U.S. Reportable Accounts Guidance Notes" (PDF). Inland Revenue, New Zealand. يوليو 9, 2014. p. 3, Introduction (1). Archived from the original (PDF) on أغسطس 12, 2014. Retrieved أغسطس 22, 2014.

- ^ Agreement between the government of the United States of America and the government of the Republic of Singapore to improve international tax compliance and to implement FATCA, U.S. Department of the Treasury.

- ^ "2013 Treaties and Agreements". United States Department of State.

- ^ "FATCA agreement". State Secretariat for International Financial Matters. Archived from the original on يوليو 4, 2017. Retrieved يونيو 19, 2017.

The Federal Council approved the mandate for negotiations with the United States on switching to Model 1 on 8 October 2014.

- ^ "Federal Council brings FATCA Act into force". State Secretariat for International Financial Matters. June 6, 2014.

- ^ "Internationales Abkommen, Agreement between Switzerland and the United States of America for Cooperation to Facilitate the Implementation of FATCA" (in German). Archived from the original on March 8, 2014.

{{cite web}}: CS1 maint: unrecognized language (link) - ^ "Entry into force of FATCA agreement between Switzerland and United States was delayed by six months". September 30, 2013. Archived from the original on January 11, 2015.

وصلات خارجية

- FATCA Home Page per the US Internal Revenue Service entry portal subdivided by taxpayer type

- FSI Tax Posts

- U.S. Treasury FATCA Resource Center

- FATCA timeline from the Thomson Reuters FATCA site

- Poptcheva, Eva-Maria (2013). A FATCA for the EU? Data protection aspects of automatic exchange of bank information (PDF). Library of the European Parliament. p. 6.